Shoppers walk past a placard that states "Black Friday preview" at a Macy's store as pre-Thanksgiving and Christmas holiday shopping accelerates at the King of Prussia Mall in King of Prussia, Pennsylvania, November 22, 2019.

Mark Makela | Reuters

Black Friday isn't quite the deal frenzy it used to be.

Retailers have been touting bargains for weeks. With more shopping moving online, it has only become easier to compare prices, and so the lure of doorbuster deals is losing its grip on shoppers.

That only means more bad news for a group of retailers that has long been dependent on the shopping holiday to push them "into the black," or toward profitability: America's department stores.

"Historically, [department stores] were the ones around that had the biggest voices in the '70s and '80s," said Sucharita Kodali, retail analyst at Forrester Research, in an interview. "That was when a lot of these sales became more popular."

Department stores have relied on winning shoppers' dollars on Black Friday more than other types of retailers, she said. The hope has been that shoppers will stock up on items they need for themselves, like bath towels and bedding sets, in addition to picking up gifts for others.

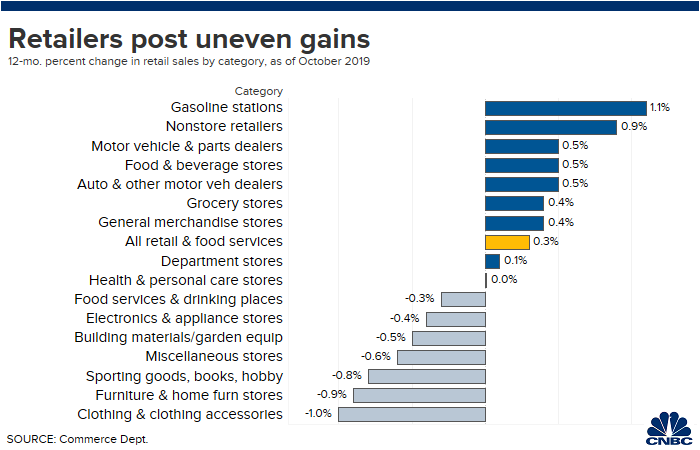

But now, it shouldn't come as a surprise to most people that department store chains such as Macy's, Kohl's and J.C. Penney are struggling to drive shoppers to malls. These companies are finding themselves in sales slumps.

"If they are declining in influence, and their big day was Black Friday," consider what that means for Black Friday and for this group of retailers, Kodali said.

It's true, there are still the traditionalists, who feel the holidays aren't complete without a post-turkey trip to the mall. These are the shoppers who thrive by lining up in the cold, waiting for a retailer's doors to open in the wee hours of the morning, hoping to score a deeply discounted kitchen appliance or office gadget.

Department stores in particular are known for handing out those kinds of doorbuster deals, which are only available in limited quantities for a short period of time. But today, with the internet at consumers' fingertips, the appetite to jockey through crowds for coupons or buy one, get one offers has waned.

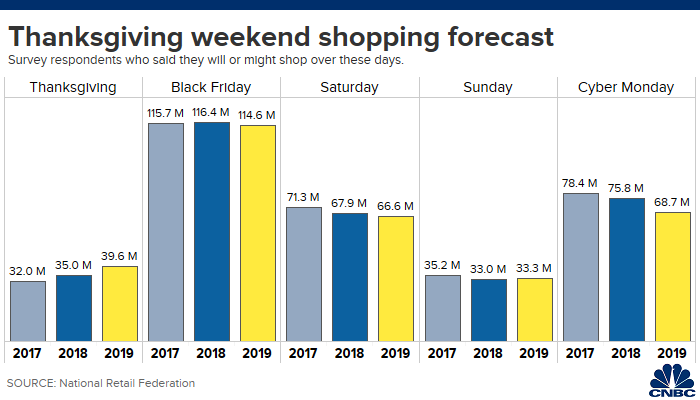

"Black Friday no longer represents a narrow window of opportunity in which shoppers have to wait in the cold and sprint into stores to get unmissable deals," Coresight Research founder and CEO Deborah Weinswig said. "Holiday shopping now occupies much of November and has warmups much earlier in the year, as holiday shopping increasingly becomes a year-round activity."

"Cyber Monday eclipsed Black Friday a couple of years ago," in terms of sales, she said. ShopperTrak is still calling for Black Friday to be the busiest shopping day of the year in the U.S., in terms of foot traffic.

Some say the holiday shopping started as early as July, thanks to the timing of Amazon's Prime Day event. But there are a slew of other reasons as to why Black Friday isn't what it once was.

Putting the pressure on department stores, big-box companies like Best Buy, Target and Walmart have turned to offering sitewide deals online, across the span of a few weeks. Amazon started its Black Friday deals last Friday, while it launched other deals even earlier in the fall. Walmart started offering holiday deals, "earlier than ever" this year, on its website in October.

This upcoming weekend, the deals will still be plentiful, with Penney offering 50% off Disney's Frozen 2 toys, Kohl's offering $60 off the Fitbit Versa Lite and Macy's giving away plush pillows at no cost after a mail-in rebate, as just a few examples. But, on the whole, the cadence of good deals beyond just Black Friday has picked up from what it used to be.

"Competition has reduced the relevance of [Black Friday]," Forrester's Kodali said. "And the customer benefits from all of this."

Some say the chaotic scenes that have played out on Black Fridays in the past, where shoppers burst through doors as stores open and tackle each other for flat-screen TVs and DVDs, have led to the day losing some of its steam. Retailers are trying to smooth out the commotion.

"There used to be an element of having a line [wrapped around your store]," KeyBanc Capital Markets analyst Ed Yruma said in an interview. "It was a little bit of retail theater."

Still, retailers, and department stores need to participate in Black Friday. Even with the deals creep, the day can drive substantial sales by itself.

Black Friday in 2018 generated 6% to 7% of total quarterly sales for mall-based retailers like American Eagle and big-box businesses like Best Buy, according to analytical intelligence firm 1010data. A normal day of sales for a retailer, 1010data said, accounts for about 1% of quarterly sales, to put that spike into perspective. So Black Friday is equal to about an extra week of sales for some retailers.

"Black Friday is a strong period for things like toys and electronics," Yruma said. "Walmart and Target will have a lot of momentum. ... There is that customer that is really looking for value."

Department stores could use the boost on Black Friday to round out a rough year.

Macy's, Penney and Kohl's all had dismal earnings reports earlier this month. Macy's and Kohl's slashed their annual profit outlooks. While Nordstrom's results were above analysts' expectations, its sales were still down 2.2% from a year ago. Its full-line business is struggling more than its value-oriented, off-price Rack stores.

Kohl's cited the fact that competitors have been pushing deals heavily and are expected to continue to do so for the remainder of the year. Macy's said more of the same, and while it said it didn't slash prices during the third quarter to compete, it plans to do so during the holiday quarter.

"We foresee a highly promotional holiday environment that retailers should be prepared for given a tough third quarter, particularly for women's apparel and mall and department store retailers," Cowen and Co. analyst Oliver Chen said.

Macy's shares, which have a market value of $4.8 billion, are down more than 47% this year, putting the stock on pace for its worst year since 2008. Kohl's shares are down more than 27%, bringing its market value to $7.7 billion. Nordstrom's stock has fallen about 18% in 2019, putting its market value at nearly $6 billion.

Penney shares are up about 13% year to date, moving the stock back above $1. Penney, which is valued at $37 million, earlier this year was at risk of being delisted from the NYSE. The stock first fell below $1 in December 2018.

Business - Latest - Google News

November 27, 2019 at 12:11AM

https://ift.tt/2QWzyJJ

Black Friday is losing its clout. And that's more bad news for department stores - CNBC

Business - Latest - Google News

https://ift.tt/2Rx7A4Y

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

No comments:

Post a Comment