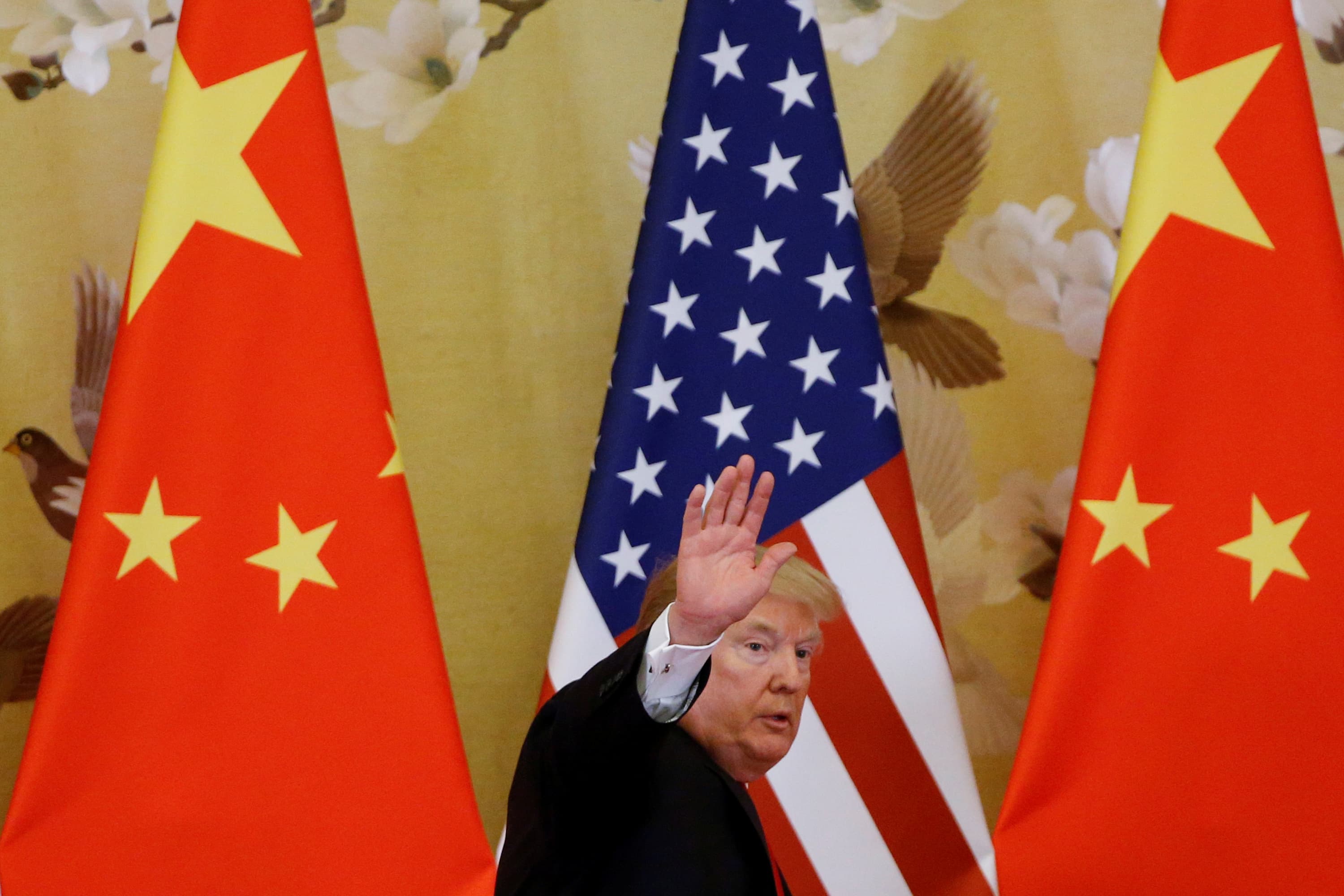

President Donald Trump needs to cut a trade deal with China because his reelection prospects rest on keeping the stock market and the economy strong, Wharton School professor Jeremy Siegel told CNBC on Tuesday.

"He cannot afford to let that slip. He knows it. His political advisors know that. A year from now, we can't be lower on the stock market than we are, and our economy has to be better. So it's up to Trump make a deal," said Siegel, a closely followed market observer whose mostly bullish take on stocks over the years has been correct.

Since May 5, when Trump surprised investors with tweets threatening higher tariffs on China, the S&P 500 has lost about $1.1 trillion in value — the type of decline that if it were to persist could put a real drag on U.S. economic growth.

Monday alone saw the S&P 500 drop 2.4%, its worst single-day since early January, after China retaliated for Trump's slapping 25% tariffs on $200 billion worth Chinese imports on Friday. The index has fallen nearly 5% since its intraday all-time high set on May 1.

Meanwhile, the Office of U.S. Trade Representative is taking the necessary steps to impose tariffs of the remaining billions of dollars worth of Chinese goods coming into the U.S.

"The market wants a solution. Don't forget, the market didn't really want this trade war to begin with," Siegel said in a "Squawk Box" interview. "Let's not rock a boat that's going well."

One week after Siegel told CNBC that stocks could drop 10% to 20% if the U.S. and China were to dig in during trade talks, he said, "The market is going to continue to react" if Trump wants to push China to be the end.

"You can pull victory out of defeat. No one is really going to look at the details," the Wharton professor said, stressing that the president has a bully pulpit to cast any agreement with China as a victory even if it's just so-so.

CNBC's before the bell news roundup

SIGN UP NOW

By signing up for newsletters, you are agreeing to our Terms of Use and Privacy Policy.

via IFTTT

No comments:

Post a Comment