Rising oil prices at the start of 2018 prompted President Donald Trump to unleash a barrage of abusive tweets at OPEC. This year, the oil market is giving the commander-in-chief plenty of ammunition.

The cost of Brent crude oil is now higher than it was at the same time last year. The international benchmark for oil prices hit a four-month high at $68.69 on Thursday, and big banks like Goldman Sachs and Morgan Stanley are warning Brent will soon rise toward $75 a barrel.

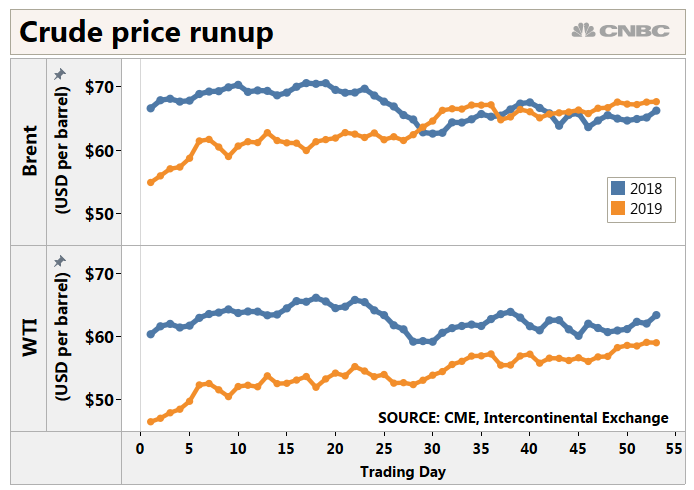

Brent has rallied 27 percent his year, while U.S. benchmark West Texas Intermediate crude is up 32 percent in 2019 — though WTI is still trailing last year's price a this time. The oil market is drawing support from OPEC-led production cuts, Trump's sanctions against Iran and Venezuela and demand growth that is beating bearish forecasts.

The setup was similar last year when Trump fired his first presidential salvo at OPEC at the end of April, followed by several more tweets throughout 2018. Trump went silent after OPEC defied him by launching new production cuts in December, but last month, he put the group on notice.

@realDonaldTrump: Oil prices getting too high. OPEC, please relax and take it easy. World cannot take a price hike - fragile!

"You've got to believe we're due for a Trump tweet at some point," said John Kilduff, founding partner at energy hedge fund Again Capital.

Rising oil prices are starting to hit Trump where it hurts: the gasoline pump.

U.S. gasoline futures are outpacing the oil price rally, surging 44 percent this year. Analysts say there are several reasons for that, but the bottom line is Americans are paying more to fill up their gas tanks.

The national average gas price has risen 35 cents since January and now sits at $2.58 per gallon, according to GasBuddy. The run-up has been particularly pronounced in the Midwest, with Michigan's price surging 75 cents and costs in Ohio and Illinois up more than 60 cents.

"It's been nothing short of madness at the pumps since early January with retail gasoline prices on a tear, especially in the Great Lakes," Patrick DeHaan, head of petroleum analysis at GasBuddy, said in a briefing on Wednesday.

"The news doesn't get much better either. Motorists can expect the jumps at the pump to continue into April, and perhaps even lasting up to Memorial Day, when the transition to summer gasoline and refinery maintenance have generally wrapped up."

As gasoline prices bubble up, Trump's opportunities to influence OPEC policy suddenly narrowed this week.

On Monday, a committee of OPEC members and their allies canceled an April meeting meant to review their deal to keep 1.2 million barrels per day off the market. The move leaves the output curbs in place until June, when the full group next meets.

Meanwhile, OPEC Secretary General Mohammed Barkindo has been trying to improve the group's image among Americans, including by pushing back on a bill meant to hobble the organization at last week's CERAWeek by IHS Markit conference in Houston.

The No Oil Producing and Exporting Cartels Act, or NOPEC, would allow the Justice Department to sue OPEC members for coordinating production, the group's primarily lever for adjusting oil supply and prices.

"Not only is OPEC showing a willingness to ignore the White House's renewed call to open the taps, but the messaging from the organization is more assertive in saying that US shale producers would be a prime casualty of the NOPEC bill that is being considered by Congress," Helima Croft, global head of commodity strategy at RBC Capital Markets, said in a research note on Wednesday.

"In our view, economic self-interest will continue to trump satisfying Washington and thus, we do not see any extraordinary OPEC production policy changes in the immediate offing."

The biggest wildcard in the NOPEC debate is Trump's support, according to IHS Markit. Trump backed the legislation in his former life as a real estate developer and reality television star, but as president, he has forged close ties with OPEC heavyweights like Saudi Arabia and the United Arab Emirates.

Yet Trump's decision could boil down to the direction of oil prices, IHS Markit said in a research note on Wednesday.

"Trump ultimately supporting and signing NOPEC is unlikely in our view but cannot be ruled out, and will ultimately be tightly linked to the oil price," IHS Markit analysts wrote. "If prices rise above $80/bbl the likelihood of Trump starting to talk about and supporting NOPEC would rise significantly – and broader Congressional urgency would grow."

via IFTTT

No comments:

Post a Comment