A surprise jump in business spending boosted fourth quarter growth to 2.6 percent, but economists say the first quarter could grow at half that pace due to the government shutdown and a sluggish consumer.

Fourth quarter GDP topped the 2.3 percent expected by economists, due in part to a 6.7 percent increase in equipment spending and a 13.1 percent jump in intellectual property, which includes software. The pickup was a surprise after weak durable goods spending data in the quarter.

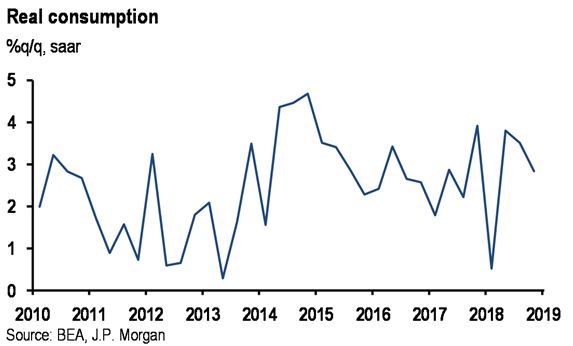

While business expenditures look better, economists say the sharp drop in retail sales in December signals a weaker consumer at the start of the year. That will make for a tougher comparison, and even before the fourth quarter report, economists were looking for first quarter growth below 2 percent with a pickup in the second half.

Consumers at the end of 2018 were facing the stock market's sharp holiday season decline, the prospect of a government shutdown, and rising interest rates. The government remained shutdown for most of January

"The White House, and fairly so, can claim bragging rights for 2018. The real question is the first quarter. You're well under 2 percent. Are you under 1 percent? We don't know yet," said Joseph LaVorgna, Natixis chief economist for the Americas.

The Bureau of Economic Analysis said 2018 growth was 2.9 percent, a calculation derived by averaging growth in each quarter, but Wall Street economists, who measure growth on a fourth-quarter-over-fourth-quarter basis, say growth was 3.1 percent for 2018, up from 2.5 percent for 2017.

By either measure, the growth rate was close to the 3 percent the Trump administration promised would be generated by its economic policies. But the first half of 2018 already looks to be well below that pace, even if the second quarter picks back up, as economists expect. The final GDP number for fourth quarter will be released on March 28, and it could be revised in either direction.

The pickup in business spending, therefore is critical, and if it continues, could dispel some doubts that corporations are not using tax proceeds for investment but for things like stock buybacks and dividends. It also suggests there may have been less delayed spending because of uncertainty surrounding trade.

After the fourth quarter report Thursday, Macroeconomic Advisors economists trimmed their first quarter growth estimate by 0.1 percentage point to 1.1 percent, citing an unexpectedly large inventory build at the end of the year which implies a decline in inventory investment in the first quarter.

"I'm at 1.5 percent. We've got a slowdown in the first quarter, hopefully from transitory affects from the government shutdown and polar vortex. Hopefully there will be a snap back in the second quarter," said Grant Thornton chief economist Diane Swonk. She expects second quarter growth of 2.5 percent.

"You're slowing down the run rate, but it's still above the modest potential the economy has. That's the good news. The bad news is it's not enough to grow us out of our deficit problems," Swonk said.

Kevin Cummins, senior economist at NatWest Markets, said his forecast for the first quarter coming into the fourth quarter report was 1.1 percent. The first quarter has traditionally been weak, and this year should be no different due to weather and other factors.

"We do show pretty solid growth in business investment in Q1. It really suggested that consumption was the main slow down there," he said. "It's really an artifact of the weakness we saw at the end of Q4, rather than a fundamental weakening in the first quarter. You're base level is weak at the end of the fourth quarter so it's a really tough comparison."

Cummins said the 1.2 percent decline in retail sales for December may not be revised, as some economists expect, when January retail sales are finally reported on March 11. The retail sales report, like much government data, was delayed by the 35-day government shutdown, which ended in late January.

The government said that the shutdown trimmed fourth quarter growth by 0.1 percentage point.

Swonk said the comparison for the consumer this year will also be tougher because there was a boost from the tax cut last year and individuals saw less tax withheld from their paychecks.

"We start the year with slower spending because of the government shut down and the polar vortex," she said."The good news is we've seen wage gains in low wage jobs. That is helping boost spending at the low end, but we're not seeing it ripple into the middle class, where we'd like to see more broad based gains."

via IFTTT

No comments:

Post a Comment