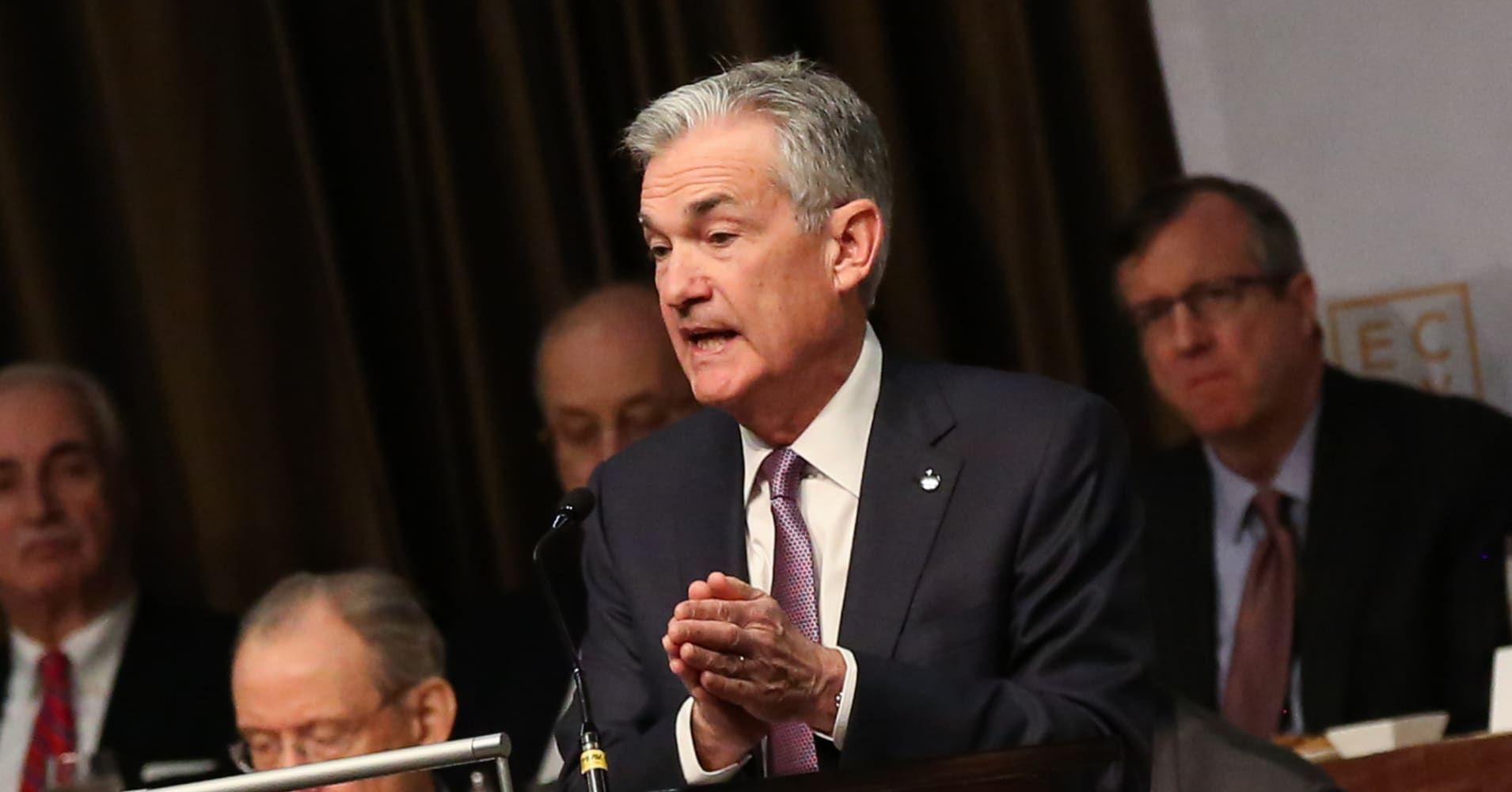

Jerome Powell heads to Capitol Hill this week to do something he's struggled with lately: convey the Federal Reserve's future intentions without upsetting financial markets.

Since October, the central bank chair has suffered a series of missteps and backtracks.

It began in October with his pronouncement that the Fed was "a long way" from a neutral interest rate, continued in December when he said the process of reducing the balance sheet was on "autopilot," then ran into January and February when remarks he made seeming to pivot off his previous stance generated criticism that he was operating at Wall Street's whims.

His mandated remarks this week, first before the Senate Banking Committee on Tuesday then a day later before the House Financial Services Committee, allow him a chance to chart a clearer course that features less vacillation and more sensitivity.

"The market will be watching very closely to try to confirm that it heard nothing new," said Matt Toms, chief investment officer for fixed income at Voya Investment Management. "There's a desire for nothing new, for a moment of a 'let's never fight again' relationship between Powell and the markets. The markets have been fully liking what they've heard lately, and I think it's going to listen to make sure no new news comes out."

Indeed, investors likely have had enough of the turmoil that visited the fourth quarter of 2018. Major indexes slumped, momentarily hitting a bear market on belief that Powell and his Fed cohorts were not listening to the signals the market was sending.

Market participants essentially are looking for three components to Powell's appearance, during which he will provide prepared remarks followed by question-and-answer sessions: a commitment to a go-slow approach to future rate hikes, an acknowledgement of the challenges balance sheet reduction poses, and thoughts on the economy, considering renewed chatter from Fed executives lately about the weak pace of inflation amid a global growth slowdown.

"The market is so relieved about what they believe is a very supportive and dovish message" from policymakers recently, Toms said. "That leaves the risk to the downside."

Wall Street is especially concerned with the balance sheet, in particular that Fed officials acknowledge that allowing bond proceeds to run off each month, a process nicknamed "quantitative tightening," is also having an impact on financial conditions. Powell and his predecessor, Janet Yellen, both have said they expect the process to run with little disruption, but many market participants disagree.

"If the balance sheet was such a revolutionary, extraordinary tool that helped, then why is the removal of it inconsequential?" Toms said.

Striking the right tone, then, will be vital for Powell to convince the market that the Fed is mindful that normalizing the most extreme monetary policy accommodation in U.S. history comes with risks.

Powell helped assuage markets with his more cautionary message at January's Federal Open Market Committee meeting and in public remarks since. A turn away from that accommodative stance could spook investors.

"There's a risk more to the downside that in December he was hawkish, then in [the January] press conference he was bending over backwards to be dovish, and I think he's still trying to get his voice on that," said Gary Pollack, head of fixed income trading at Deutsche Bank's private wealth unit. "The risk is he may go the other way, back to being slightly more hawkish. That's more a balance from the last thing he said."

One area where Powell will need to straddle the fence is the economy.

Part of the problem with his communications back in the latter part of 2018 was a market perception that Powell wasn't seeing that the global slowdown was beginning to ithe U.S. The extension from that fear was that the Fed would continue to tighten policy no matter what the data showed.

This week, then offers a challenge to walk the line between awareness of the economic signals but along with a long-stated Powell belief that the U.S. appears to still be growing solidly.

"There are some signs of an actual slowdown in the U.S. So I think it would be nice to see the Fed acknowledge that," said Shawn Snyder, head of investment strategy for Citi Private Wealth Management. "It would be nice to get an expression from him that they're looking to sustain the expansion and not hold it back."

The most recent communication from the Fed came in the minutes from the January FOMC meeting, which indicated a high level of concern about market reaction to policy moves, with members stressing the patient stance toward additional rate hikes.

Snyder said Powell should continue to emphasize a relaxed policy stance.

"Right now people think the next policy move could be a rate hike or a rate cut," he said. "It would be nice for the market to think the next policy move would be a pause and potentially a rate cut. The market wants to hear them be even a little more dovish."

via IFTTT

No comments:

Post a Comment