Shares of Nvidia tanked as much as 14 percent just before the market open on Monday after the company lowered its revenue guidance for the fourth quarter citing "deteriorating macroeconomic conditions, particularly in China."

The warning adds Nvidia to a growing list of U.S. companies facing revenue challenges in the country. Earlier this month, Apple issued a rare revenue warning following slowdowns in the Chinese market.

Nvidia reports earnings on Feb. 14, and now expects quarterly revenue of $2.20 billion, down from previously stated guidance of $2.70 billion.

The company also pointed to headwinds in gaming and datacenters. Other chip stocks also fell following the announcement.

Here's the full statement from the chipmaker:

NVIDIA (NASDAQ: NVDA) today updated its financial guidance for the fourth quarter of fiscal year 2019, reflecting weaker than forecasted sales of its Gaming and Datacenter platforms.

In Gaming, NVIDIA's previous fourth-quarter guidance had embedded a sequential decline due to excess mid-range channel inventory following the crypto-currency boom. The reduction in that inventory and its impact on the business have proceeded largely inline with management's expectations. However, deteriorating macroeconomic conditions, particularly in China, impacted consumer demand for NVIDIA gaming GPUs. In addition, sales of certain high-end GPUs using NVIDIA's new Turing™ architecture were lower than expected. These products deliver a revolutionary leap in performance and innovation with real-time ray tracing and AI, but some customers may have delayed their purchase while waiting for lower price points and further demonstrations of RTX technology in actual games.

In Datacenter, revenue also came in short of expectations. A number of deals in the company's forecast did not close in the last month of the quarter as customers shifted to a more cautious approach. Despite these near-term headwinds, NVIDIA has a large and expanding addressable market opportunity in AI and high performance computing, and the company believes its competitive position is intact.

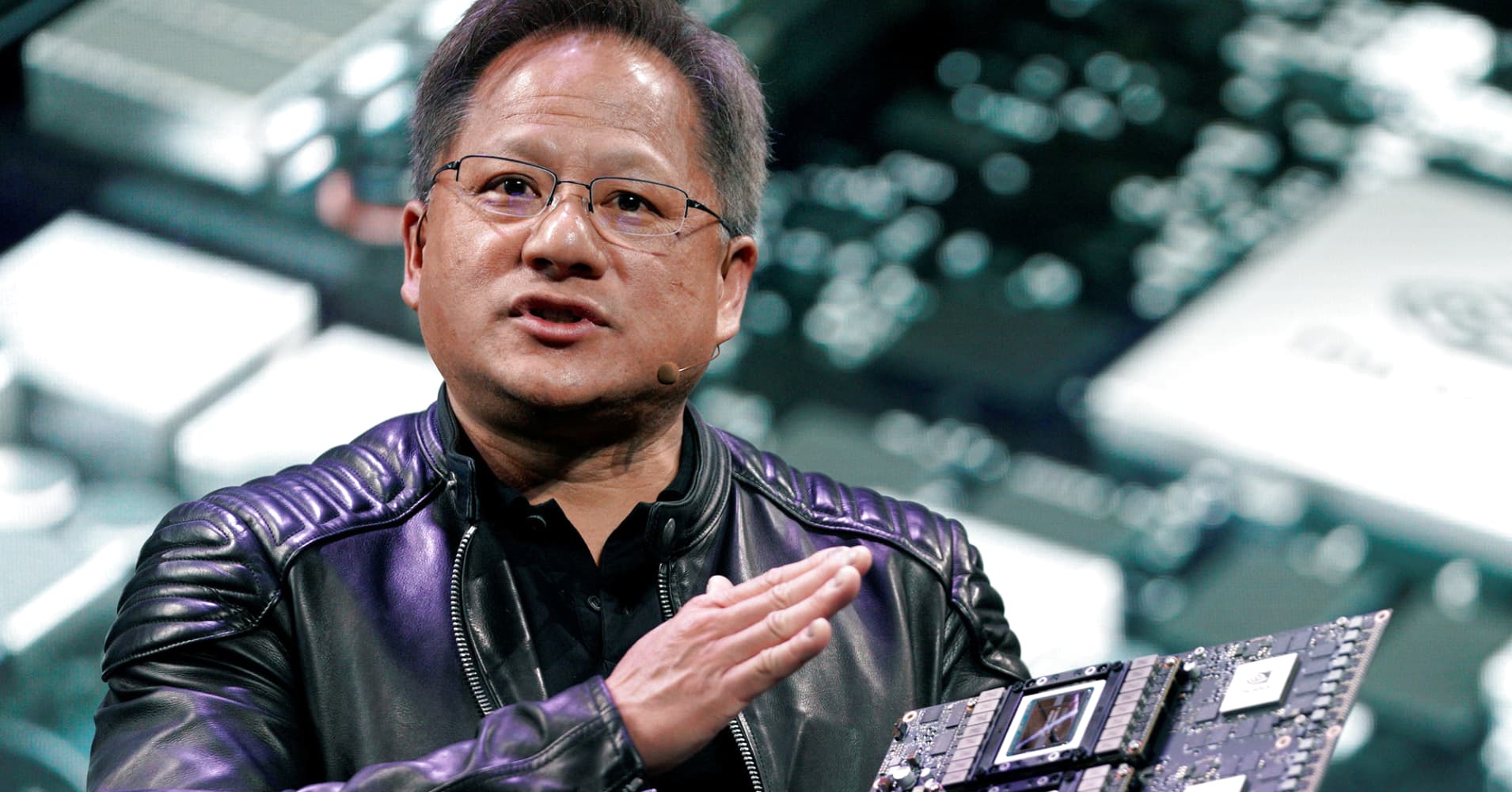

"Q4 was an extraordinary, unusually turbulent, and disappointing quarter," said Jensen Huang, founder and CEO of NVIDIA. "Looking forward, we are confident in our strategies and growth drivers.

"The foundation of our business is strong and more evident than ever – the accelerated computing model NVIDIA pioneered is the best path forward to serve the world's insatiable computing needs. The markets we are creating – gaming, design, HPC, AI and autonomous vehicles – are important, growing and will be very large. We have excellent strategic positions in all of them," he said.

NVIDIA expects its GAAP and non-GAAP gross margin to be impacted by approximately $120 million in charges for excess DRAM and other components associated with the updated revenue guidance and current market conditions.

The company will provide Q4 fiscal 2019 financial results and Q1 fiscal 2020 guidance on its earnings call scheduled for Feb. 14.

This story is developing. Please check back for updates.

from Top News & Analysis https://cnb.cx/2S6Kfunvia IFTTT

No comments:

Post a Comment