At this point last year, the market was in a roughly similar spot, but the mood could hardly be more different.

The S&P 500 was up 7.4 percent year-to-date this time last January, in one of the best starts to any year, and investors were giddy, greedy and comfortable, on the whole, with the reasons for the gains.

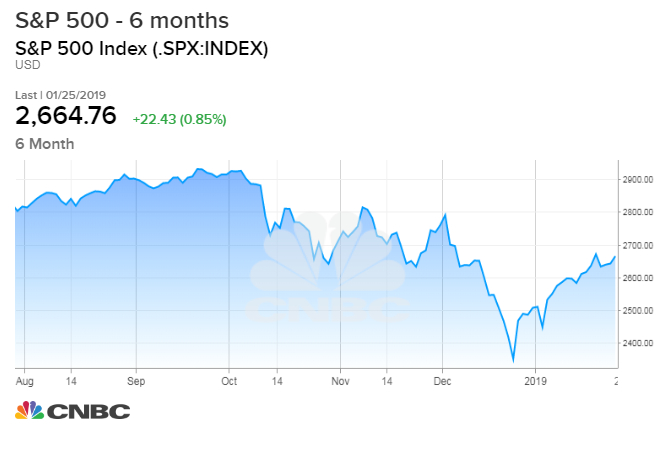

Today the index is ahead by 6.3 percent less than four weeks into the year, and investors are relieved but also ambivalent and gun-shy — unsure if the bear raid of the prior few months is over or only in abeyance.

The fragile psychology and tentative stance of market participants right now will probably serve the market well for a while, according to strategists who track supply-and-demand dynamics and the market's own response to fundamentals.

Fundstrat Global Advisors strategist Thomas Lee says, "Investor conviction is low, whether a bull or a bear — not surprising given the savage volatility seen in December 2018, which effectively destroyed the playbooks for most investors."

Tobias Levkovich of Citigroup notes that this attitude prevails globally: "A trip visiting clients in Singapore, Hong Kong, Taipei, Tokyo, and Sydney left us with the sense of underlying discomfort with the market's strength since last December."

The S&P 500 was almost exactly flat last over the four trading days last week after dropping more than 1 percent Tuesday - a creditable showing given its 13-percent sprint from Dec. 26 through last Friday's high. The index remains nearly 10 percent off its September high, preventing many long-term investors from running any victory laps.

A pullback appeared logical from the Jan. 18 closing high of 2670, and one still does. But the neutral, diffident sentiment and still-reserved level of risk-taking among professional and institutional investors is a net positive and would limit the depth of a setback, all else being equal.

The final week of January in 2018, of course, marked the sentiment, momentum and valuation peak of this bull market so far — reflecting the most overbought, overloved, overvalued condition seen since the year 2000. At that time, the just-passed tax-cut was juicing corporate-profit forecasts and stoking animal spirits — and the main risk to the market seemed an overheating U.S. economy firing up inflation and inflaming Federal Reserve tightening intentions.

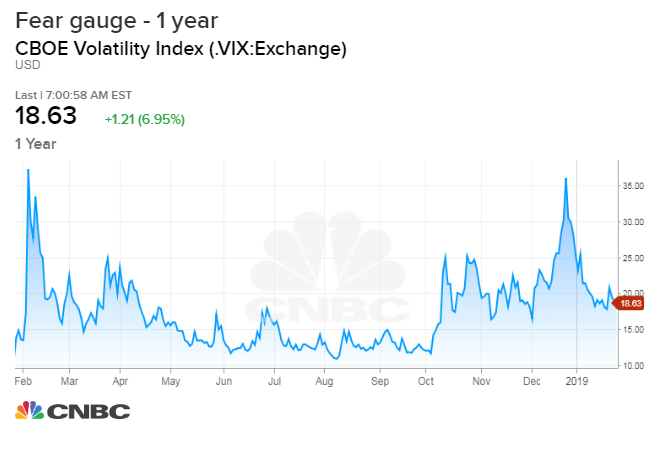

That's far from the current situation. The S&P 500 valuation is about neutral, on earnings forecasts slipping. Traders are wary, shown in part by the stickiness of the CBOE Volatility Index hanging up near the somewhat elevated 20 threshold in recent weeks despite the rally — a sign that demand for downside hedges has held up.

Wells Fargo equity-derivatives strategist Pravit Chintawongvanich said Thursday, "Light positioning and cautious sentiment is probably the biggest argument for near-term bullishness. Significant de-risking happened in Q4 '18, and most investors don't seem to have caught the rally on the way back up."

After Friday's jump of 0.9 percent toward the recent highs, the VIX finally sagged toward 17, and he added, "With the market grinding higher volatility is taking a beating. People are still cautious, but if we keep grinding higher [and] dips keep getting bought, people will be pulled into the market. [Investor] positioning [is] still light."

For better or worse, this is not an uncommon take at the moment. The global strategy team at Bank of America Merrill Lynch, bearish for months heading into the global equity tailspin last year, has been playing the bounce and says it should continue, because "positioning and policy argue tactical surprise is further rally in risk."

So far, companies are "beating" sharply reduced earnings forecasts by a slimmer margin that the average of recent years — yet on balance the reporting-companies' shares are outperforming in response. Another hint of sober expectations built into the market to date this year.

Deutsche Bank notes that systematic funds that use momentum, volatility, technical and quantitative factors have only partially rebuilt their exposure to equities. And the public has continued to pull money from stock mutual and exchange-traded funds, on a net basis, even with the market finding its footing in the past month.

So, yes, the wall of worry that the market is said to climb remains in place, if not standing nearly as tall as at the December depths.

But it's not for nothing that worry persists, right?

Even if the market meltdown in December was an apparent over-anticipation of a sudden rise in recession risk, nothing has liberated Wall Street from concerns over the wind-down of this long economic expansion.

Nomura cross-asset strategist Charlie McElligot says hedge funds remain positioned cautiously relative to normal risk profiles, "as the 'end-of-cycle' skepticism remains sticky...and the background noise of trade negotiations dragging on."

The now-halted government shutdown might serve Wall Street's purposes in a backdoor way, cementing the Fed's "patient" stance and allowing investors to dismiss noisy or weak first-quarter economic data. Still, the recent rally shouldn't obscure the fact that the rebound doesn't do anything to disprove the idea that it remains a bear-market environment. The breadth and power of the upside reversal around the turn of the year is a point against the bear scenario, but not a decisive one.

The whole ballgame for the market is whether the fourth quarter was just a passing scare over a "zero growth moment" and possible Fed mistake, or the real thing.

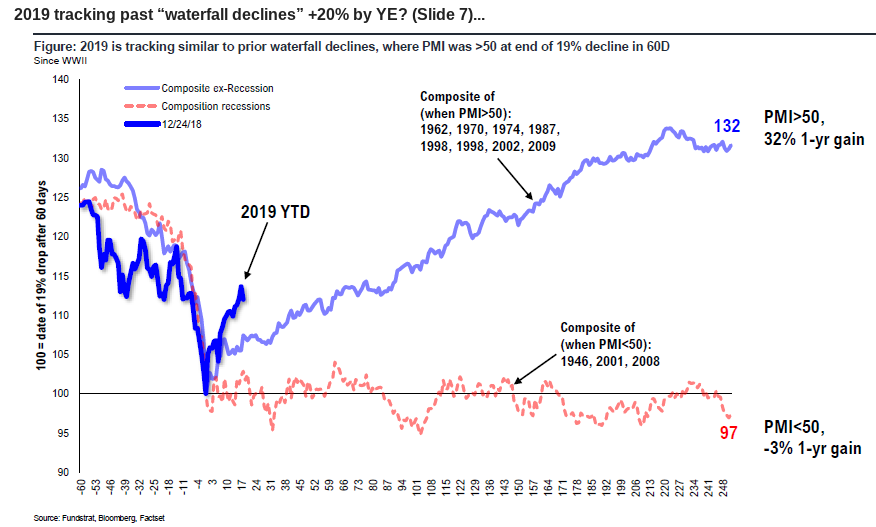

Fundstrat fashioned separate composite charts showing past "waterfall" declines of around 20 percent and how the S&P did afterward, based on whether the manufacturing index showed expansion or contraction.

Even if this episode luckily ends up in the "false alarm" category, the angle of the rally has been far sharper than average, implying a good chance of backsliding no matter what the news flow. That's when the bulls would be banking on the cautious mood and timid positioning to buffer the downside. For now, both are in place.

via IFTTT

No comments:

Post a Comment