A dam collapse connected to an iron ore mine owned by Vale has killed dozens of people in southeastern Brazil and left rescue workers with little hope of finding survivors among the hundreds still missing.

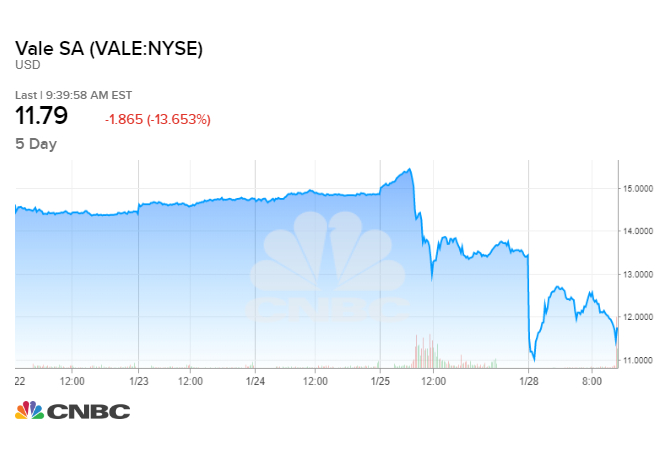

Shares of of Vale plummeted amid a wave of investment bank downgrades, as fines and penalties began to mount and the ultimate impact on Vale's finances remained uncertain.

The tragedy is the second major disaster linked to Brazilian mining giant Vale in about three years. In 2015, another dam at the Sarmarco mine jointly owned by Vale and BHP Billiton burst, killing 19 people in Minas Gerais state and causing Brazil's worst environmental disaster.

In both cases, a dam holding back a tailing pond burst, spilling torrents of sludge into the surrounding area. The reservoirs contain byproducts from mining operations known as tailings.

The collapse at Vale's Corrego do Feijao mine near the city of Brumadinho on Friday, also in Minas Gerais, was not as large as the 2015 Samarco disaster, but it has proven far more deadly.

By Monday, the Minas Gerais fire department officials had confirmed at least 60 people dead, according to Reuters. About 300 people are still missing, and fire officials say they do not expect to find many survivors.

At the time of the accident, the reservoir contained nearly 12 million cubic meters of tailings, compared to about 50 million cubic meters during the Samarco disaster. The dam was built in 1976 and purchased by Vale in 2001. It was slated to be decommissioned and was last certified as stable in September.

According to Vale, the dam's safety rating was "in accordance with the world's best practices" and exceeded standards in Brazil.

The disaster has created a cloud of uncertainty around Vale's business.

The stock price for the ADR traded in the U.S. were down about $2, or 15 percent on Monday, striking a new 52-week low at $11.33 per share. On Friday, the price plunged about 8 percent.

Several investment banks downgraded shares of Vale, but struck a cautious note until investigations are complete.

"The financial impact of Friday's dam failure is impossible to quantify at present, but it is likely to be significant. We would also expect some production disruptions and more stringent safety inspections in the Brazilian iron ore industry," investment bank Jefferies said in a research note on Sunday.

Vale disclosed that judges have frozen about $2.9 billion in assets. Brazil's environmental protection bureau IBAMA and Minas Gerais have fined the company $66 million and $26 million, respectively.

The company is suspending its dividend payments to shareholders and setting up a pair of independent committees to create a plan to support victims and recovery efforts and to investigate the cause of the accident.

"There are reasons to think that the impact on Vale could be substantial given this is the second failure in three years and the significant loss of life as a result of this event," said BMO Capital Markets. "However, with the dam independently certified as safe as recently as September 26, 2018, the impact on Vale is difficult to quantify."

BMO downgraded the stock to market perform and cut its price target to $13 per share. Jefferies and HSBC knocked the stock down to hold and lowered their price targets from $18 per share to $14 and $14.50, respectively. On Monday, Macquarie Research downgraded Vale shares to neutral.

via IFTTT

No comments:

Post a Comment