Bitcoin might come in handy for some type of dystopian future. But in the meantime, investors may want to look for other safe-haven bets, according to J.P. Morgan.

Barring an all-out loss of faith in all major currencies — the dollar, euro, yen and gold — the firm remains doubtful.

"We have long been skeptical of cryptocurrencies' value in most environments other than a dystopian one characterized by a loss of faith in all major reserve assets," J.P. Morgan managing director and analyst Jan Loeys wrote in a note to clients this week.

Given cryptocurrencies' sky-high returns and low correlation to traditional assets like equities and credit, bitcoin backers had cited it as an ideal way to diversify a traditional portfolio.

But J.P. Morgan judges crypto as deficient for two reasons: The trouble of extrapolating past risk-return properties "of an emerging financial asset displaying bubble-like properties," similar to technology stocks in the 1990s. The second was digital currencies' inability to outperform during periods of equity market draw-downs, like the summer of 2015 and February 2018, "perhaps due to their own overvaluation."

"Even in extreme scenarios such as a recession or financial crises, there are more liquid and less complicated instruments for transacting, investing and hedging, in part due to the scale afforded by fiat currencies' legal tender status," Loeys said.

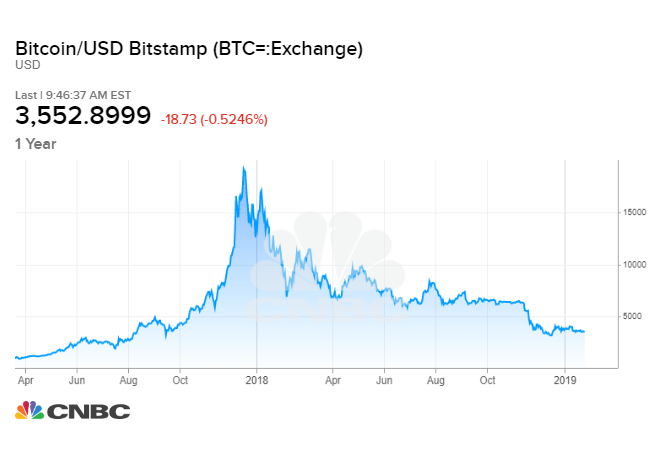

As stocks struggled at certain points last year, so did bitcoin. The Dow plunged 1,500 in a single day in February, and bitcoin meanwhile dropped more than 9 percent. The world's largest and best-known cryptocurrency is more than 80 percent off of its almost $20,000 high hit in December 2017. Year-over-year, bitcoin has lost about 70 percent of its value and was trading near $3,587 on Friday.

In the report, Loeys predicts bitcoin could tumble as low as $1,260 "if a bear market persists." Its cost support likely sits around $2,400, according to the report.

While prices have plummeted in what some are calling "crypto winter" as an opportunity to buy cheap assets. While many initial coin offerings have flopped, cryptocurrency developers continue working on new use cases and M&A has remained strong. Still, J.P. Morgan isn't convinced.

"Developments over the past year have not altered our reservations about these assets' role in global portfolios, even if their novelty value can remain high indefinitely," Loeys said.

J.P. Morgan's CEO Jamie Dimon has been among the most vocal, well-know critics. The CEO has called it a "fraud" and warned investors that if they were "stupid enough to buy it" they would "pay the price one day." When asked at the World Economic Forum in Davos if he took any satisfaction in being right about bitcoin plunging, Dimon told CNBC "didn't take any."

Still, Dimon advocated for its underlying technology, blockchain. But the research note this week outlines hurdles remaining hurdles to its mass adoption.

"Blockchain is unlikely to re-invent the global payments system, but instead can provide marginal improvements to various parts of the process," Loeys said. "Progress has been made to move blockchain adoption beyond experimentation and use in payments, but development has been largely confined to use cases like smart contracts, record keeping and decentralized applications rather than an institutionalized approach."

from Top News & Analysis https://cnb.cx/2CMSj9Vvia IFTTT

No comments:

Post a Comment