As stocks enter the short Thanksgiving holiday week, investors looking for any signs of a market comeback are paying close attention to trade developments with China.

President Donald Trump gave the market a boost Friday when he said he was hopeful the U.S. and China would strike a deal on trade, a major focus for stocks. But White House officials later downplayed his comments and said there were no signs of a deal coming soon.

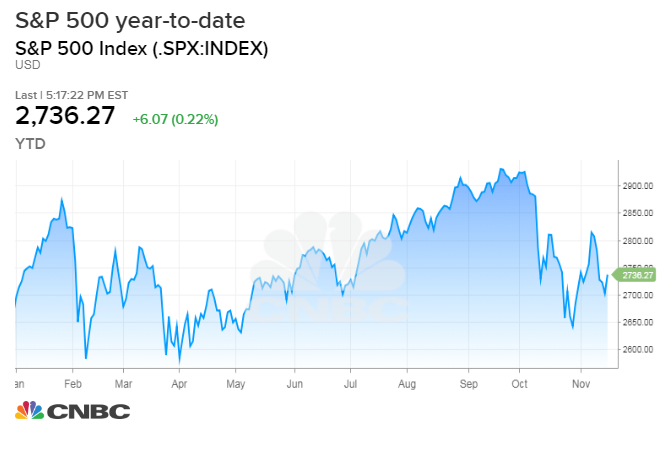

Stocks closed with gains in the S&P 500 and Dow on Friday and a slight loss in the Nasdaq. But the past week was the first negative week in three, with the S&P down 1.6 percent, and Nasdaq off more than 2 percent as tech took a pounding and Apple lost more than 5 percent on the week.

"Everyone knows the 800-pound gorilla in terms of risk is the meeting between Trump and Xi," said Julian Emanuel, chief equities and derivative strategist at BTIG. The market has been hanging on every development ahead of Trump's meeting with China President Xi Jinping at the G-20, which begins at the end of the month.

In the week ahead, Wednesday brings durable goods, consumer sentiment and existing home sales data. Retailers continue to report earnings, with Target, TJX, Best Buy and Kohl's all expected Tuesday.

More often than not the Thanksgiving week is a good time for stocks, but strategists have also been warning the market could retest the October lows before heading higher. According to the Stock Trader's Almanac, the Dow was up in the week before Thanksgiving 19 of the past 24 years. Since 1988, the Almanac says, the Dow was higher Wednesday and Friday of Thanksgiving week 18 of 29 times.

Strategists had been expecting the post-midterm election period to be a positive for stocks, with the market heading higher in the fourth quarter. But with the recent turbulence, the midterm pattern and even a Santa rally have been in doubt.

"We have been thinking of this basically as the typical 10 percent plus correction that we've seen numerous times since the bull market started in 2009. There is literally nothing we have seen over the last seven or eight weeks that would lead us to believe otherwise," said Emanuel. "The correction started with the uncomfortableness of rates rising too fast, similar to February, and then in the middle of the stock market turn down, it flipped to extreme growth fear. In our view, neither point of view is warranted."

Emanuel said it may also be a positive that the Fed has slightly changed its tone to sound more dovish. He said that was his perception when Fed Chairman Jerome Powell spoke Thursday and indicated that positive growth overseas is important. The markets have been concerned about global growth being impacted by falling commodities prices, the higher dollar and trade friction.

Positive trade developments could be a catalyst that could snap the stock market out of its funk and ignite a year-end rally, but strategists also say a negative outcome could keep the market under pressure.

CFRA investment strategist Lindsey Bell said "we see the trade dispute with China as the single most concerning issue facing the market near-term."

"Not much may come from the [Trump-Xi] meeting, which the market may be able to absorb, but a lack of a trade deal or an escalation of the current situation without a plan for resolution by year end could result in an ugly start to 2019 for global equities as well as the U.S.," Bell wrote.

Some strategists believe there could be some signs of progress made at the Argentina G-20, but Trump may still raise tariffs to 25 percent in January and put tariffs on more goods.

Emanuel said even just signs of potential progress would be a positive. "The president is sensitive to the stock market as a reflection of how people are judging his performance. He looks at the weakness of the several weeks with probably as much, if not more, concern than the average investor, given all the headwinds he's going to face politically, given the fact you now have a divided government," said Emanuel. "If we're right, there's going to be some sort of progress you can point to. The market will rally well in advance [of the meeting.]"

Barclays economists Friday said in a note that they see more signs of a possible U.S.-China agreement, as the dialogue between the two countries has become more productive ahead of the G-20.

"The potential outline of an agreement: A smaller trade deficit and increased market access in exchange for tariff relief. In our view, a 'framework agreement' at the G20 could include commitments by the Chinese to purchase more US exports — primarily in agriculture and aircraft — and steps to increase openness to the Chinese economy for US services companies," they wrote.

Monday

Earnings: Intuit, L Brands, Urban Outfitters, Agilent, JD.com, Xiaomi

9:40 a.m. New York Fed President John Williams

10:00 a.m. NAHB survey

10:45 a.m. New York Fed's Williams

Tuesday

Earnings: Lowe's, Medtronic, TJX, Campbell Soup, Best Buy, Target, Kohl's, Analog Devices, Autodesk, Barnes and Noble, Foot Locker, Hormel, BJ's Wholesale

8:30 a.m. Housing starts

8:30 a.m. Philadelphia Fed nonmanufacturing

Wednesday

Earnings: Deere, Cheetah Mobile, Qudian

8:30 a.m. Jobless claims

8:30 a.m. Durable goods

10:00 a.m. Existing home sales

10:00 a.m. Consumer sentiment

Thursday

Thanksgiving holiday

Friday

9:45 a.m. Manufacturing PMI

9:45 a.m. Services PMI

via IFTTT

No comments:

Post a Comment