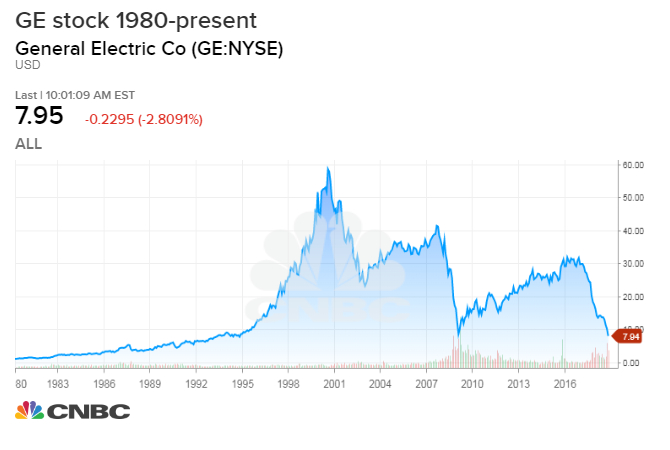

Once-mighty General Electric is fighting to stay off the junk heap.

GE's stock has become a sliver of its former self, and its bonds are now trading as if they are already junk-rated. That puts pressure on new CEO Larry Culp to quickly raise cash and cut debt to keep its debt rating from falling further to sub-investment grade junk status, otherwise known as high-yield.

"When the market begins to price you to junk status, you have a very limited time to clear that up before you become junk," said Thomas Tzitzouris, director and head of fixed income research at Strategas. "Whether their plan is viable or not, they're running out of time."

Tzitzouris said GE is not even close to becoming high-yield rated yet, but it will have to prove it deserves to stay investment grade. The company's goal is to regain its A rating after S&P cut it to BBB-plus last month. But should GE become a 'fallen angel,' its debt service costs would rise and it would face a new round of selling pressure on both its stock and bonds.

Six weeks ago, Culp replaced John Flannery, who was viewed as too slow at fixing what ailed the conglomerate after he took over from long time CEO Jeff Immelt. Culp was once CEO of Danaher Corp., a science and technology conglomerate

This week GE moved to sell $3.7 billion of its stake in oil field services company Baker Hughes. On Friday, GE took another step toward its previous announced planned $25 billion reduction in GE Capital assets with the sale of its $1.5 billion healthcare equipment finance portfolio to TIAA Bank.

But GE needs to continue to show results and too many questions remain, strategists say.

Goldman Sachs equity analysts Friday cut their target on GE shares to $9 from $12, and said they do not "see GE as inexpensive given its leverage profile... and tail risk associated with GE Capital."

GE stock fell more than 2 percent and was trading below $8 Friday. Goldman analysts said it is still unclear how much of a capital infusion GE Capital will need. They said the funding gap could be as much as $20 billion through 2020, which could be filled by asset sales and an equity infusion from its parent.

The Goldman analysts also said GE's power business sales continue to decline, and they expect 2019 to be another down year. These are the type of doubts swirling around both GE's stock and debt.

"What investors generally don't like is uncertainty and lack of direction. We're transitioning through that period right now," Jonathan Duensing, director investment grade corporate debt at Amundi Pioneer. "The more clarity and the more action the management team can deliver on, that will start to really repair the situation, not only for the business itself but from a confidence standpoint. A lot of this is because investors' confidence has been shaken."

Culp said, in an interview this week, that he feels the "urgency" to reduce the company's leverage and will do so through asset sales. He said there could be a possible IPO of the company's health care business.

"We have no higher priority right now than bringing those leverage levels down," Culp said Monday in an interview on "Squawk on the Street" with CNBC's David Faber.

GE has about $115 billion in debt, which it easily built up when it was one of just a few blue chips with a coveted triple-A standing. But GE lost that crown in 2009. The company has a mix of debt, and has access to $40 billion in revolving credit lines.

Once beloved for its healthy dividend and earnings consistency, GE found it no longer could afford the quarterly payout and recently reduced it to just a penny to free up cash. GE stock has cratered to levels it reached during the financial crisis. On top of that, the SEC has been investigating its accounting, including the $22 billion non-cash charge it took in the third quarter related to acquisitions in its power business.

GE's ripples were felt across the bond market this week, and its woes are one reason for the jump in spreads in corporate and high-yield debt. Investment grade spreads widened out by about 10 basis points and high yield by about 40 through Thursday.

"The big fear in the market all year has been that you have a lot of very large BBB rated structures and eventually some of these could be downgraded into high yield. Then comes GE. GE obviously is an ongoing story but now recently they actually got downgraded to BBB. GE is a very large BBB rated structure and it's pricing like high yield," said Hans Mikkelsen, head of high grade credit structure at Bank of American Merrill Lynch. Mikkelsen said he's not an expert on GE but the market views it as having downgrade risk.

A big credit sliding into the junk bond world would pressure yields in that market and trigger forced selling in the downgraded credit.

"Is this the beginning of a downgrade to high yield? My view is no. This is not that story. To me, GE was a single A-rated name that may or may not end up high yield for completely idiosyncratic reasons," Mikkelsen said.

Mikkelsen said other factors were also moving the market this week, including the steep drop in oil, and the turbulence in bonds of PG&E, the California utility which said earlier this week its insurance may not cover its potential liabilities in the . He expects to see corporates stabilize and see buying into year end.

GE BBB-plus senior debt is now three steps above junk, and it is also part of the largest BBB tier in the $5 trillion investment grade debt market. Half the investment grade market is now rated BBB, another concern in the market.

Mikkelsen said GE has about $50 billion in debt that is BBB rated, which is equal to about 0.8 percent of the investment grade market but would be 3.9 percent of the $1.2 trillion high yield market. It is 1.5 percent of BBBs.

"Our view is that GE is small enough, and the story sufficiently idiosyncratic, to leave other large BBB capital structures relatively little affected as this story plays out," Mikkelsen wrote.

But strategists say GE has to clarify where it is going. In the interview, Culp said the troubled power business was close to bottoming.

Duensing also said GE is not representative of trouble for the BBB tier of the market. "It's not a BBB thing. This is a company that has been struggling to manage their overall business platforms from an operational standpoint, and now it's in a situation where it's not only impacting the equity price, it's impacting the debt spreads because credit agencies moved on the credit rating and investors have lost confidence," he said. "That's a more specific issue."

But still, GE is a big new member of the BBB ranks, at a time when interest rates are rising and investors are concerned about where potential problems may be found in the next economic downturn.

from Top News & Analysis https://ift.tt/2qT3rMFvia IFTTT

No comments:

Post a Comment