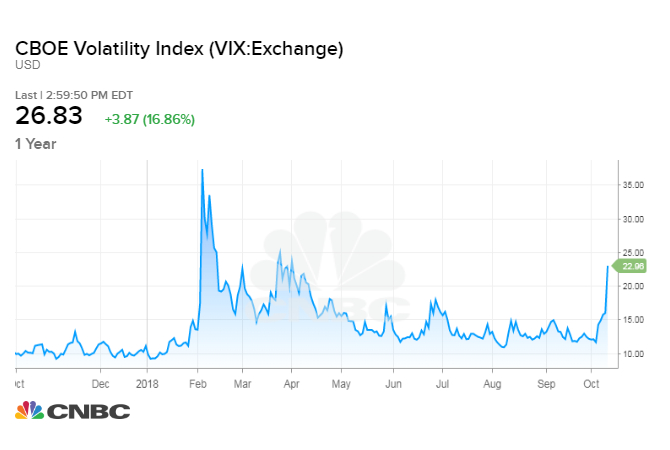

Wall Street's favorite fear gauge, the Cboe Volatility Index, hit its highest level since mid-February as traders accelerated stock selling during Thursday afternoon.

The VIX hit a high of 28.84 after 2 p.m. ET, its highest level since Feb. 12, 2018.

The VIX measures the prices of put options on the S&P 500 versus the prices of call options. A rising VIX theoretically means investors are getting more concerned about the market and placing more bets to protect themselves.

Stocks added to steep losses for the week Thursday, a day after the major indexes suffered steep losses sparked by higher rates and a sell-off in tech shares.

The Dow Jones Industrial Average fell 500 points Thursday, bringing its two-day losses to more than 1,400 points. The S&P 500 dropped 2.1 percent and was on pace for a six-day losing streak. The broad index also broke below its 200-day moving average for the first time since May.

The Nasdaq Composite pulled back 1.5 percent and entered correction territory.

from Top News & Analysis https://ift.tt/2A6BjLAvia IFTTT

No comments:

Post a Comment