Politics, it's been said, creates strange bedfellows. So does the auto industry these days.

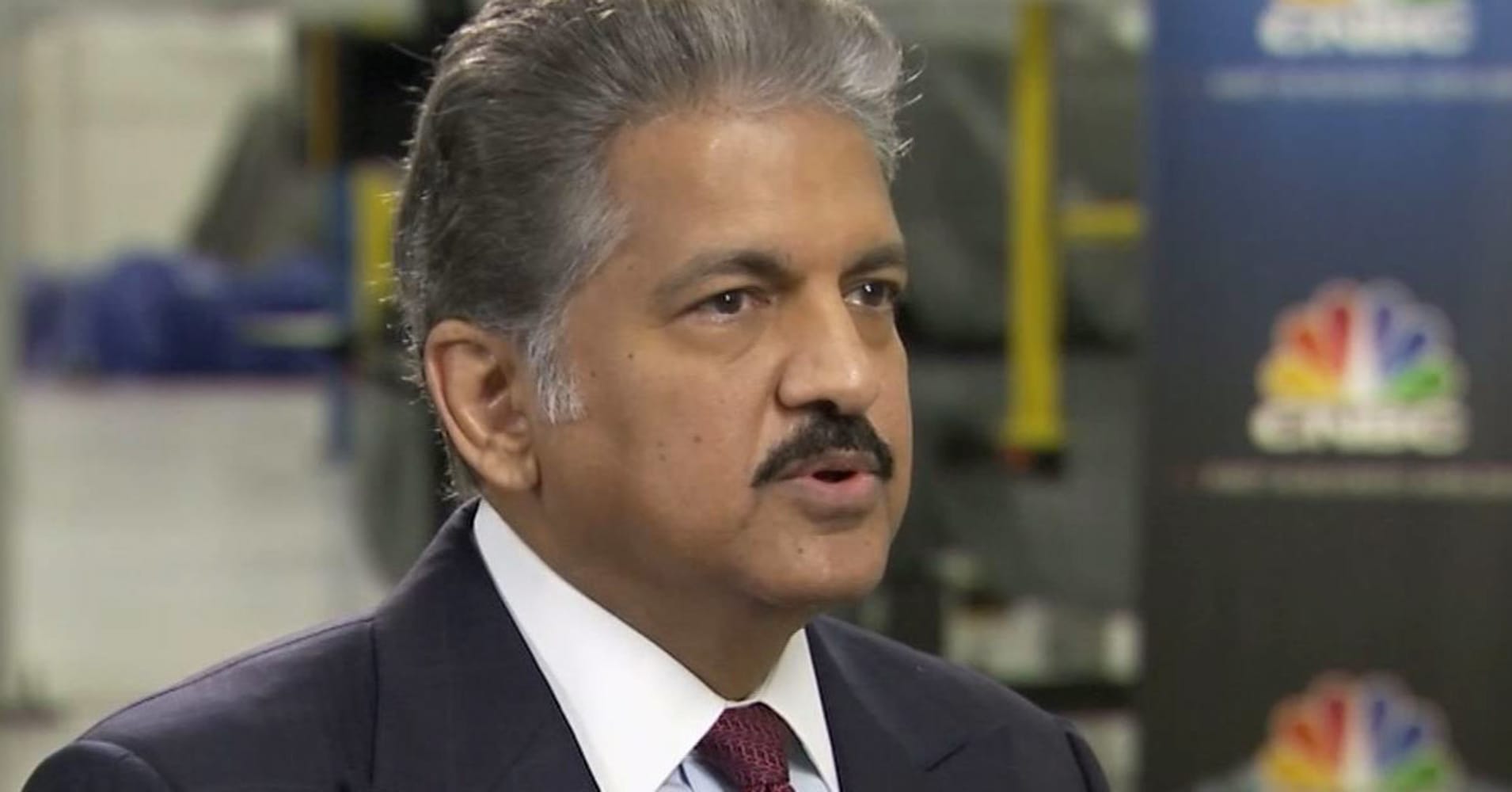

Ford this week announced plans to expand its work with Mahindra Group, one of India's largest car companies, to find ways to collaborate on advanced powertrains, connected car technologies and even new vehicles.

The new agreement comes as the auto industry rumor mill buzzes with reports of a possible new partnership between Ford and Volkswagen. Meanwhile, the No. 2 automaker's cross-town rival, General Motors, this past month announced a tie-up of its own to an erstwhile rival, Hondawhich is planning to invest $2.75 billion over the next decade on the joint development of autonomous vehicles.

The sheer cost and technological burden of developing self-driving cars, electric vehicles and other advancements has companies that have historically been fierce competitors becoming, at the very least, frenemies. They're forming new alliances, joint ventures and agreements to help develop and build new technologies that may take years to get to market and even longer before turning a profit. While some Odd Couple alliances are more successful than others, all share a common cause.

"When you think about how much it costs to develop these future technologies — it's immense," Autotrader executive analyst Michelle Krebs told CNBC earlier this month. "And we don't know when they'll be ubiquitous, when they'll get any return on that investment. So they're sharing the cost. They're sharing the risk."

Volkswagen announced almost a year ago that it plans to spend $40 billion to develop autonomous and electrified vehicles through 2022. It is expected to invest billions more by 2025 when it hopes to have 50 all-electric vehicles filling out the product lineup of brands ranging from mainstream Seat, Skoda and VW to exclusive marques Audi, Bentley and Lamborghini. And the German automaker isn't alone.

"Everybody has to spend billions on electrification, and billions on autonomy and mobility services, even while they have to spend billions on their conventional product lines," said John McElroy, host of the TV program "Autoline Detroit." "Nobody has that much cash."

Some manufacturers, like GM and Ford, teamed up a few years back to work on a few components when they developed new, fuel-saving nine- and 10-speed automatic transmissions.

Other partnerships can last decades. Daimler has been working with the Euro-Asian Renault-Nissan-Mitsubishi Alliance for nine years. The Renault-Nissan-Mitsubishi deal has been in place since 1999. It's just short of a full-fledged merger. Though each carmaker remains independent, they share some equity and routinely cooperate on everything from parts purchasing to product engineering and manufacturing.

The Renault-Nissan-Mitsubishi Alliance collectively sold 10.6 million vehicles in 2017, making it one of the three largest automaking groups in the world. Alliance CEO Carlos Ghosn contends the carmakers couldn't have come close without that partnership, which reportedly generated 5.7 billion euros in "synergies" last year.

At a news conference at the Paris Motor Show earlier this month, Ghosn and Daimler AG CEO Dieter Zetsche said their joint efforts added up to substantially more savings by allowing them to expand their individual product portfolios and enter new markets. Daimler joined the group as the world was still reeling from the Great Recession.

Daimler's Mercedes now uses a four-cylinder engine produced by Nissan for vehicles it assembles at its own factory in Vance, Alabama. Nissan's luxury line Infiniti partnered with Mercedes on a new assembly plant in Aguas Caliente, Mexico. Together, the companies came up with the underlying "architecture" used for both the new Smart fortwo and Renault Twizy microcars.

"I can tell you the synergies we developed here are significant and can go further," said Ghosn, with Zetsche adding that he sees plenty of "blank spaces" left for the partners to explore.

Even small, short-term deals can yield substantial savings. The development of a transmission, especially today's most fuel-efficient versions, can run into the hundreds of millions of dollars. Pooling resources, GM and Ford got two new ones for little more than they separately would have paid for a single automatic gearbox.

Not every alliance works out as planned, of course. A decade ago, GM, BMW and what was then Chrysler partnered on the development of a new hybrid drivetrain. The partnership was plagued with problems and the final product fell short of expectations. The carmakers quickly abandoned the technology.

In 2005, meanwhile, GM had to shell out $2.5 billion to exit from an ill-fated partnership with Fiat. Ironically, that helped provide the financial foundation the Italian company needed for it to acquire Chrysler when it was in bankruptcy a few years later.

One of the challenges, industry experts stress, is to ensure there's a common vision for what the partners intend to do. But another challenge is "making sure the corporate cultures can get along," said David Cole, director-emeritus of the Center for Automotive Research in Ann Arbor, Michigan.

That was one of the problems that sank the GM/Fiat partnership, Cole and other analysts suggest, as well as the ill-fated "merger of equals" that became DaimlerChrysler. It's something Daimler boss Zetsche told CNBC he had to focus on getting right when the German carmaker started working with Renault, Nissan and later Mitsubishi.

One of the big questions during the joint news conference in Paris on Oct. 3 was whether the four manufacturers' partnership will survive when Zetsche hands off the reigns as CEO next year.

"Without the chemistry between us, maybe this wouldn't have happened," Zetsche said, nodding toward Ghosn. But considering the results the partnership has generated, "I don't see from my perspective why the momentum in this relationship should change."

Similar questions are being asked about whether Ford and Volkswagen will be able to move beyond the memorandum of understanding they signed in June. But company officials are upbeat.

"Ford is committed to improving our fitness as a business and leveraging adaptive business models — which include working with partners to improve our effectiveness and efficiency," said Jim Farley, Ford's president of global markets. "This potential alliance with the Volkswagen Group is another example of how we can become more fit as a business, while creating a winning global product portfolio and extending our capabilities."

The alliance between GM and Honda appears to be moving in the right direction. The two companies already have partnered on the development of hydrogen fuel cells, a technology some see as a viable alternative to battery power. The basic hardware was provided by Honda, but they will now have to find a way to mass produce it at a GM plant in the Detroit suburbs.

Under the new agreement, meanwhile, the Japanese automaker will spend about $2.75 billion over the next decade as part of a partnership aimed at speeding up the development of self-driving vehicles. That will include a $750 million investment in Cruise Automation, GM's San Francisco-based autonomous vehicle subsidiary that is aiming to start production sometime in 2019.

"Our mission is to deploy this technology safely at massive scale," GM President Dan Ammann told CNBC earlier this month. "That's going to require a lot of resources — not just financial resources but also engineering resources."

Bob Lutz, GM's former vice chairman, said the pressure on the industry to develop new technology is intense and cost isn't the only factor driving unlikely business partners.

"There are so many demands on automakers these days for plug-in hybrids, fully electric vehicles, autonomous vehicles, semi-autonomous vehicles," Lutz told CNBC earlier this month. "There is not enough engineering manpower to go around."

These days, it's difficult to find an automaker that doesn't have some sort of alliance in the works. Daimler has not only taken an equity stake in Aston Martin but is providing the British sports carmaker with V-8 engines and infotainment technology.

Then there's the Japanese giant Toyota. It teamed up with niche maker Subaruto develop a low-end sports car both brands now sell. It subsequently followed a similar path for another low-volume model.

After years struggling to find the right business plan to bring the once-popular Supra back to life, Toyota turned to BMW. The Bavarian carmaker was finding it impossible to pencil in a case for developing an all-new version of its Z4 roadster. The German model debuted in Paris last month and Toyota has confirmed it will unveil the reborn Supra early next year, likely at the Detroit Auto Show.

With rare exception, automotive alliances aren't monogamous. Toyota also has teamed with Mazda. Together they are developing new battery-electric vehicles that will be assembled at a new, $1.6 billion factory they are building in Huntsville, Alabama.

The "coopetition," cooperation among competitors, isn't limited to deals between automakers. Tech companies are joining the fray.

Japan's Softbank, for one, announced its own, $2.25 billion investment in GM's Cruise subsidiary last May. Google signed on with the Renault-Nissan-Mitsubishi Alliance in May to develop the group's new infotainment system, which is expected to integrate some Google Home capabilities.

Expect to see even more alliances, said AutoTrader's Krebs. The ones announced in just the last few months demonstrate that partnerships are "necessary to take on these expensive ventures that likely will not return a profit in the near term," she said.

via IFTTT

No comments:

Post a Comment