A decade later, the three officials who helped pull the U.S. out of the financial crisis struggle with the choices they made, particularly considering that the public still sees the moves as a bailout for Wall Street.

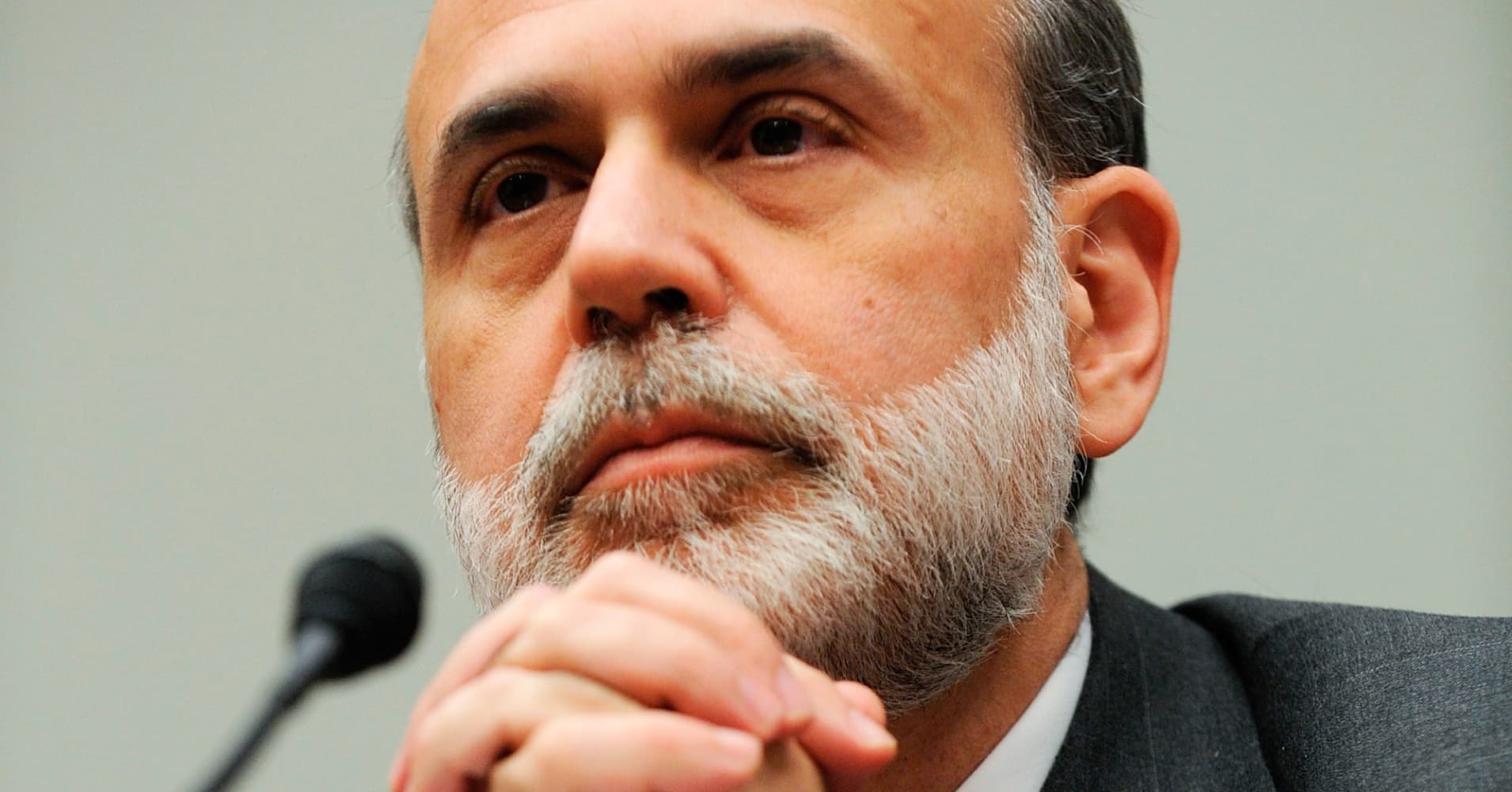

Speaking Wednesday during a forum in Washington, D.C., former Federal Reserve Chairman Ben Bernanke, Treasury Secretary Hank Paulson and New York Fed President Timothy Geithner reflected on the daunting events before, during and after the crisis.

The three spoke during a forum at the Brookings Institution think tank in a talk moderated by CNBC's Andrew Ross Sorkin, who wrote "Too Big to Fail," a chronicle of the crisis told from the inside of those who experienced it first-hand.

"We stepped in before the banks had collapsed and we did some things to fix the financial system which are very hard to explain because they are objectionable things," Paulson said. "In the United States of America there's a fundamental sense of fairness that the American people have ... You don't want to reward the arsonist."

However, they said doing nothing would have caused the economy to capsize. They acknowledged that some of the terms were distasteful, but they were necessary given the options at hand. Programs like the Troubled Asset Relief Program pumped money back into banks and restored liquidity to the system.

While they believe the actions were essential, the former officials also recognized the areas where they failed. Paramount among those failures was the inability to save Lehman Brothers, whose collapse Sept. 15, 2009 intensified a crisis that began six months earlier with the failure and bailout of Bear Stearns.

"We thought it was going to be bad, and it was bad," said Geithner, who would go on to serve as Treasury secretary under President Barack Obama. "It was much worse than we thought, than we envisioned. It was a good lesson."

Following the Lehman failure, the financial system locked up and the future of many of Wall Street's most venerable names came into question. Years of a runaway real estate boom financed through exotic derivatives bought and sold on the Street fueled the crisis that came crashing down when the financial instruments began to default.

For Paulson, the memories of abject fear during the weekend the officials negotiated for Lehman's survival and the dark days after still haunt.

At night "I would look into the abyss and just see food lines, see a second Great Depression, wondering if one more institution went down how would we put it all back together again," he said. After learning that the Lehman deal wasn't going to get done, "I remember then just being overcome by a sense of fear. Everyone was looking to me. How was I going to deal with it?

A Bible verse his wife read him from 2 Timothy — "For God has not given us a spirit of fear, but of power and of love and of a sound mind" — helped calm him. But that didn't stop the relentless questioning from the public over why the government bailed out Wall Street.

All three agreed that it was difficult explaining how the various government programs, including cash infusions to banks and a bailout of AIG, were there to benefit the public and not those who created the crisis.

"We didn't persuade the country generally speaking that what we were doing was necessary, although we firmly believed that it was," said Bernanke, who is a distinguished fellow at Brookings. "That communication issue is still out there."

from Top News & Analysis https://ift.tt/2x56c10via IFTTT

No comments:

Post a Comment