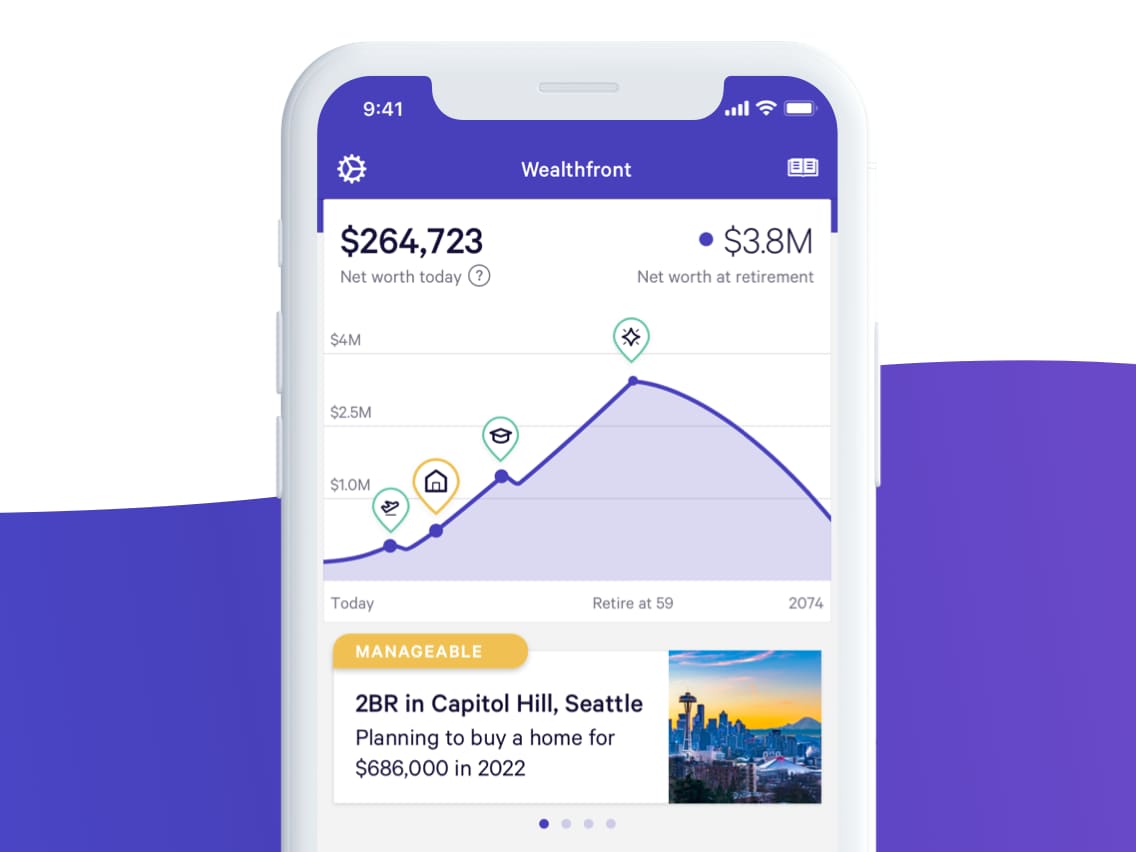

Wealthfront app.

Source: Wealthfront

Robo-advisor Wealthfront is raising the interest rate on its cash account as fintech firms and Wall Street banks battle for customers deposits with lower fees and more kickbacks.

The decade-old fintech company, which manages close to $14 billion in customer assets, is bringing its interest rate from 2.29% to 2.51%, which according to Bankrate.com is now the highest in the industry. Wealthfront launched the Federal Deposit Insurance Corporation-insured cash account, which is a type of brokerage account, in February and has since ushered in more than $1 billion in customer deposits.

"We want to make choosing our cash account a no-brainer and eliminate the need to comparison shop," Wealthfront said in a blog post Tuesday. "Our cash account is better on nearly every dimension and increasing the rate to the top of the market makes it that much easier for consumers to pick Wealthfront."

The new rate is higher than some notable high-yielding options. Ally Bank and Goldman Sachs' consumer banking arm Marcus have 2.20% and 2.25% rates, respectively. United Bank was the previous high-water mark with a 2.5% annual percentage yield. The national average for savings accounts is 0.1%, according to Bankrate. Checking accounts meanwhile, yield an average .08%.

The competition for customers' cash is heating up as fintech firms expand into banking businesses outside of their initial use cases. This year, "the battle for millennial deposits will become more aggressive as fintech account products hit the market," CB Insights senior tech analyst Lindsay Davis said in the firm's outlook report.

Wealthfront, which started as an automated wealth advisor, said it also plans to take on more bank-like functions this year with automatic bill pay, direct deposit, and debit or ATM cards. Founders Dan Carroll and Andy Rachleff, who also co-founded well-known investing firm Benchmark Capital, are betting that tech-savvy millennials don't want human interaction in their banking experience. The two are aiming to provide "self-driving" money, modeling the company after viral tech names like Netflix, instead of more obvious comparisons like Charles Schwab.

Like many of its financial start-up peers, Wealthfront works with FDIC-insured partner banks to hold customers' deposits. It partners with East West Bank, New York Community Bank, and others and because they use multiple bank partners, deposits are insured up to $1 million.

Carroll told CNBC in April that since the firm relies on automation, it's able to pass cost savings onto its clients in the form of higher interest. Wealthfront's rate is in line with the fed funds rate, the interest rate at which banks and other institutions lend money to one another, typically on an overnight basis. That began rising in 2015, and is now at a target range of between 2.25 and 2.5 percent, up from 1.75 at the high end a year ago. As that rate changes, Carroll said Wealthfront will "be making similar decisions on if our rate goes up or down."

via IFTTT

No comments:

Post a Comment