Chalk it up to the magic of Disney.

The entertainment giant's stock just had its best month since 2000, fueled by a record-breaking opening weekend for Marvel's "Avengers: Endgame" and the unveiling of Disney's upcoming streaming service, Disney+.

That puts the stock's year-to-date gains at nearly 25% — far above the S&P 500's 17% — but some experts think there's still more to Disney's rally.

"There's actually a lot of good news for a long time," Chantico Global founder and CEO Gina Sanchez said Tuesday on CNBC's "Trading Nation" segment. "Look at all of the franchises that Disney has bought. You have Marvel, you have Lucasfilm, you have ESPN, you have Pixar films. And now, with Disney+ with 7,500 shows and 500 movies, that's a lot of content, and they're producing blockbuster after blockbuster."

That slate of blockbusters — which includes live-action remakes of classic Disney films "Aladdin" and "The Lion King" — gives the stock and the company a great deal of runway, Sanchez said.

"I actually think that the fundamentals look really good, and it's not overvalued here," she said. "Disney is actually still fairly valued. That's why I think it's still an interesting buy."

Katie Stockton, founder and managing partner of Fairlead Strategies, said she'd prefer to wait for a pullback before jumping in.

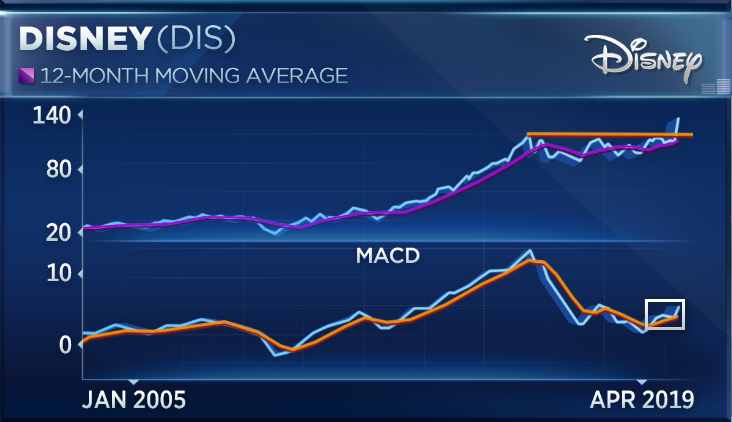

"Disney had a breakaway gap this month, and that tends to be a long-term positive development," she said, pointing to the momentum trends in Disney's long-term chart.

"It had, of course, been under accumulation for some time, saw momentum improve during that trading range, and I'm really encouraged by the follow-thorough that we saw already on back of the breakout," Stockton said. "In the short-term, it's a little bit overbought, but I'd love to add exposure to Disney into a pullback to take advantage of what would be a long-term measured move projection of about $180 on back of that breakout."

Disney shares shed nearly 2% in Tuesday's trading session, but stayed near their 52-week high of $142.37.

via IFTTT

No comments:

Post a Comment