Pedestrians pass in front of the New York Stock Exchange, May 24, 2019.

Michael Nagle | Bloomberg | Getty Images

Policymakers pulled out all the stops to fix the financial crisis, but they may have to get even more extreme when the next downturn hits.

Future crises could see a "radicalization" of the types of measures taken to jolt the economy out of its last malaise, according to an analysis by AB Bernstein that looks both at the waning effectiveness of current attempts and the shape future efforts will take.

Essentially, the view is that next time around policymakers will go even further. That means the use of "Modern Monetary Theory" — in which even more government debt is used to spur growth — along with negative interest rates and the possible step of distributing "helicopter money" or direct cash from central banks like the Federal Reserve.

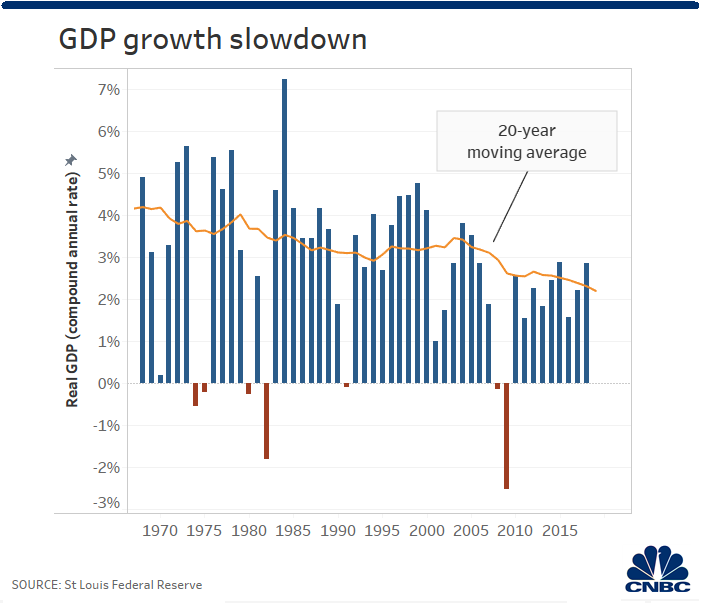

Collectively, the actions are a far more ambitious version of what Bernstein's experts call the "compulsive stimulus model" that has used debt growth and asset bubbles to drive cyclical growth at a time when the long-term trend for the U.S. economy is below-trend compared to historical norms.

"The question ultimately is not if there will be more stimulus (there will be, as the political economy nature of CSM guarantees it), but how desperately will they push for it and how creative will they get," Philipp Carlsson-Szlezak, chief U.S. economist at AB Bernstein, wrote in the report. "We think the model's declining effectiveness is an important driver of its likely 'radicalization' – a turn towards more extreme versions of stimulus."

Carlsson-Szlezak counters the argument that policymakers are running out of ammunition, though he concedes that the current batch of tools is losing its effectiveness.

The policy prescription used when the crisis hit its peak in 2008 included the Fed taking its benchmark interest rate to near-zero and instituting three rounds of quantitative easing, or bond buying that helped create bank reserves. The result was an economic expansion that is only a few weeks short of setting a record for duration, but also one that featured, until recently, mostly subpar growth. At the same time, Wall Street has enjoyed the longest bull market run in history.

That model "looks tired overall," as households are increasingly less inclined to take on excessive debt and low rates lose their effectiveness, Carlsson-Szlezak wrote.

"This declining effectiveness is important to consider because it raises the odds that the next time stimulus is called upon it may quickly find traditional approaches lacking and that may lead stimulus to more aggressive means in order to have the same desired effects," he said.

Such efforts could happen either due to an economic downturn or rising populism. MMT, for instance, has emerged not as a way to jump-start the economy but rather as the political left's method to reduce income inequality. Advocates believe that as long as central banks keep interest rates low, government can keep spending on programs that will bridge the wealth gap.

Negative interest rates

The second form of "radicalization" would be negative interest rates, something that is getting a higher level of discussion inside the Fed as officials contemplate what the next crisis response might look like. Because of its impact on banking Carlsson-Szlezak calls negative rates "the obvious extension [but] not an obvious policy choice." However, the Fed already has experience with real negative interest rates, or the difference between the nominal level and inflation, and likely at least would explore taking the next step.

Finally, there's helicopter money, which would take the Fed's QE up a notch. Where QE involved asset purchases that created bank reserves, this move would entail direct giving — say, by crediting individual bank accounts with digitized money. Legendary economist Milton Friedman floated the idea in a theoretical sense, and former Fed Chairman Ben Bernanke also introduced it as a discussion topic, earning him the nickname "Helicopter Ben."

The main question that remains is what will prompt such aggressive moves.

"The most plausible path to a more aggressive stimulus model is the occurrence of a (deep) economic crisis," Carlsson-Szelak wrote. "That said, even without that we think it's plausible that the political economy embraces dialed up version of traditional stimulus."

Since the days of the financial crisis, fiscal stimulus has been introduced only twice — former President Barack Obama's $787 billion American Recovery and Reinvestment Act aimed at "shovel ready" capital projects, government spending and tax cuts, and current President Donald Trump's $1.5 trillion Tax Cut and Jobs Act.

The Trump tax cuts have coincided with some of the fastest growth during the recovery and an unemployment rate at its lowest in 50 years. Still, critics contend that such stimulus was unnecessary for a growing economy and ultimately will cost more through higher debts and deficits. Carlsson-Szlezak calls hopes for 4% growth — which Trump had promised his policies would achieve — a "delusion," thwarted by declines in productivity growth as well as labor and capital input slowing.

"Compulsive stimulus can push as much as politicians feel they can get away with, however, without influencing the supply side variables, trend growth will not move higher and ultimately growth will converge to potential," he wrote.

via IFTTT

No comments:

Post a Comment