President Donald Trump says China wants a deal, but Wall Street is not totally convinced there will be one, even though stocks rose on the president's remarks Wednesday.

Before the market open, Trump tweeted that Chinese Vice Premier Liu He is coming to the U.S. to make a deal. Several hours later, White House spokeswoman Sarah Sanders said there were "indications" the Chinese delegation wants to reach an agreement. Both comments gave a boost to the stock market, which was higher in afternoon trading after starting the day lower.

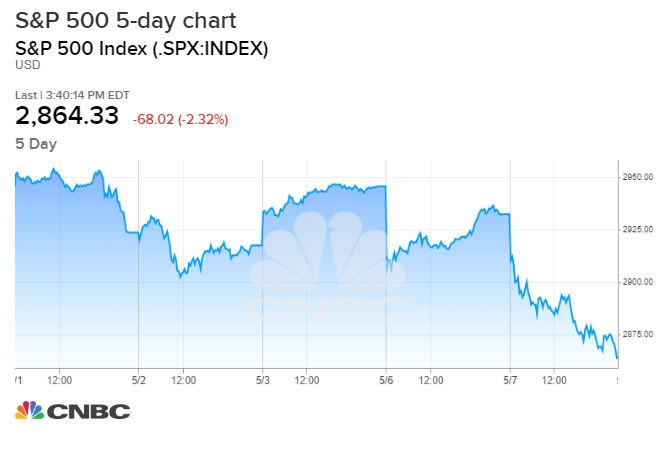

Stocks rallied Wednesday after two days of brutal selling that particularly slammed companies and sectors with exposure to China, like Caterpillar and the semiconductor industry.

Ed Keon, chief investment strategist at QMA, said it's encouraging to see stocks rally, but the situation remains uncertain. "The odds of something going wrong are much higher today than they were last Friday, when there was pretty much consensus that deal was going to be done and we would have an announcement," he said.

Keon said the market believed a deal was coming this week, based on comments from U.S. officials, so when Trump first tweeted on the weekend that he could increase tariffs on Chinese goods, it was a surprise.

"That was market consensus a deal was going to be done. I've taken a slightly more defensive position in our portfolios," he said. "If things work out this week, we'll probably go back to where we were last Friday. I would say 2% upside versus 10% downside. I would say the prudent thing is to just take some chips off the table, just in case. We're not heading for the hills. We're just being more cautious."

Stocks sold off this week on concerns an increase in tariffs on $200 billion in Chinese goods to 25% from 10% would hurt the global economy and reduce corporate profits. The S&P 500 lost 2% Monday and Tuesday. Through its commerce ministry, China Wednesday said it would take countermeasures if the U.S. raises tariffs.

Dan Clifton, head of policy research at Strategas Research, said he believes the main hang up in the talks has been about tariffs and whether they stay in place after a deal.

"The US wants some tariffs to remain in place to ensure China implements the full agreement. With the US insisting on tariffs, China pulled back on other commitments. Everything is linked. Now, Trump is offering China tariffs on $50bn or $500bn of goods. The ball is in China's court. Liu is coming to the US, an acknowledgement that there will be negotiations," said Clifton.

Marc Chandler, chief market strategist at Bannockburn Global Forex, said the dollar weakened slightly after Sanders comments about China, but there was still no way to know which way the talks will end up, after the vice premier arrives for talks Thursday.

"I would still say this is very precarious. And you are still getting the U.S. spin on things," said Chandler. "I think tomorrow is a wild card."

"What a lot of the U.S. press is missing is Vice Premier Liu He is coming a day later than originally planned, and he has a smaller delegation," Chandler said.

Luke Tilley, chief economist at Wilmington Trust, said he's expecting a deal even if it isn't sealed this week. "We're not surprised that there are bumps, as we're coming down to the what would appear to be close to the end," he said. If there is an increase in tariffs, however, it would be a worry.

"The economy can handle the escalation to 25%. What we really fear is escalation after that. The rest of the goods would be direct to consumer goods and it would start hitting consumer spending and prices in a much bigger way than the first two rounds," he said.

Jack Ablin, CIO at Cresset Wealth, said he hasn't taken money off the table yet because of the trade conflict and latest tariff threats. If the talks fall apart, he would re-evaluate positioning.

"We played U.S. small caps and emerging markets, hoping a deal gets done. Emerging will do well if there's a deal, and if not, small caps will outperform large," he said. Revenues of small cap companies are typically more dependent on the performance of the U.S. economy, rather than the global economy.

"I just think investors are sort of underestimating the scope of this deal we're trying to do. Unfortunately, I don't think it's a binary outcome," Ablin said. "They'll shake hands, but there's still going to be lingering issues that likely will be unresolved. It's great to have something behind us and certainly we don't want to see these tariffs. But my view is this is a competition for economic dominance in technology and health care, and I'm not sure this gets solved by certain trade negotiations."

from Top News & Analysis https://cnb.cx/2VcQj1Mvia IFTTT

No comments:

Post a Comment