Stocks plunged Monday on fears the trade war will now last longer and escalate further, damaging the global economy and crushing corporate profit growth.

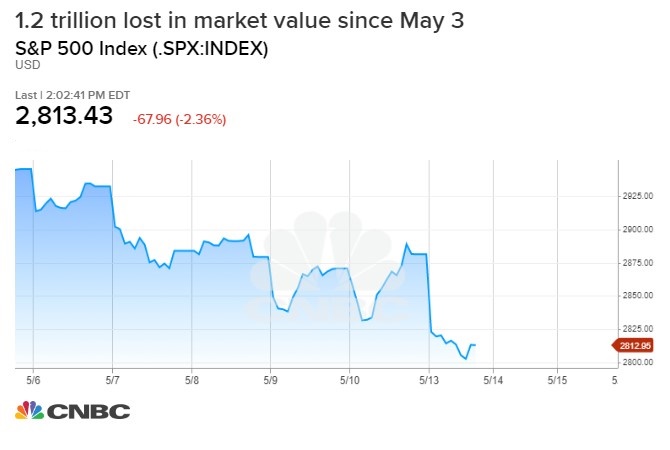

Large cap stocks, or those in the S&P 500, have now lost $1.2 trillion since President Donald Trump surprised markets with the May 5 weekend tweets that said he was thinking of raising tariffs on Chinese goods.

As China retaliated against the latest U.S. tariffs Monday, the Dow and S&P 500 were both down more than 2.6% and investors fled to bonds and other safe haven trades like gold.

Market strategists predict more pain for stocks ahead, as it prices in a more extended view of the trade battle that looked to be just a skirmish a week ago. Since his weekend threat, President Donald Trump forged ahead with higher tariffs on $200 billion in Chinese goods and says he will move forward with new tariffs on all China imports, goods totaling about $325 billion more.

China retaliated by raising tariffs on $60 billion in goods. As of June 1, Beijing will increase tariffs on more than 5,000 products to as high as 25%. Duties on some other goods will increase to 20%. Those rates will rise from either 10% or 5% previously. Products hit by the 25% tariffs include animal products and frozen fruits and vegetables. Chemicals are among goods to be taxed at 20%.

"Our view is this could escalate for at least a matter of weeks, if not months, and it's really to get the two back to the negotiating table and finish the deal, is probably going to require more pain in the markets…Really the only question is if we need a 5%, 10% or bigger market correction," said Ethan Harris, head of global economics at Bank of America Merrill Lynch.

The Dow was down about 700 points , or 2.7%, and the S&P 500 also fell 2.7%. But the Nasdaq lost 3.5%, as the sell-off was led by tech and other industries sensitive to U.S.-China trade. Tech was down 3.7%, while industrials were down 3.4%.

As stocks sold off, investors ran to the safety of Treasurys, and the 10-year yield fell to 2.39%. At the same time, the futures market was pricing in a full 25-basis point Fed rate cut for this year and most of one for next year, according to BMO.

Where's the bottom?

Julian Emanuel, head of equities and derivatives strategy at BTIG, said the market could have further to fall, and he doesn't expect it to stop until the CBOE's VIX, a measure of puts and calls, rises to 30. The VIX, commonly viewed as a fear meter, was up 32%, just above 21.

"We see downside risk to 2775, the S&P's 100-day moving average, more importantly 2,600 is an area of previous support," said Emanuel. A decline to 2,600 would be about 7%. "Trying to pick a level in the market is much more difficult. What we really want to see is a degree of fear. To us that degree of fear right now is represented by the VIX trading up to 30, which we think will happen at some point in the near to medium term."

Emanuel said some chart analysts see a potential double top in the S&P, a negative sign for stocks, and there are unresolved divergences among indexes. For instance, the small cap Russell 2000, the Dow and the Dow Transports never recovered their highs, as the S&P 500 reached an all-time high May 3. Since then, it lost more than 5%.

Market sentiment sours "when you combine [trade] with the threat from Iran and the idea of EU parliamentary elections which begin May 23 and could bring the right wing nationalists into more focus, plus the psychological damage that occured at the highs when the Fed was viewed as being less supportive than the market believed, plus the divergences."

He expects the S&P 500 to reach 3,000 by the end of the year, but he does see the Fed cutting interest rates and that will help market sentiment even before the central bank acts. The Fed, itself, says it is on hold this year, and Fed Chairman Jerome Powell and others have indicated the Fed could stay on hold and does not see a reason to cut rates for now.

'Brinksmanship'

Many investors believe the Trump 'put' will prevent the market from falling too much. The so-called 'put' is the belief that Trump will take action of the stock market is falling too much.

"The problem with the Trump put is it stretches out the battle," said Harris. "You can't trigger the put without the market going down and so, ironically, the belief in the Trump put stretches the whole brinksmanship battle out further," said Harris. "You have to kind of think of this as a back and forth between the markets and the policy makers on both sides."

Emanuel said the stock market is reacting to the fear that trade war will now be extended enough to do more and deeper damage to the economy, particularly if more tariffs are launched or China finds other ways to hurt U.S. companies on its home turf.

"The whole idea that you could skate through the trade war with no adverse effect, we already saw the adverse effects in the fourth quarter of last year in the stock market," Emanuel said. "In our view, it's actually been an adverse affect in the first quarter of 2019 with this massive plunge in yields in the U.S. as a result of global weakness in the bond market which reinforces the disinflationary mindset of the Fed."

Over the weekend, Trump continued to tweet about China, blaming it for the breakdown that has delayed a deal that was expected this month.

Harris said both Trump and China's President Xi Jinping, no doubt, feel emboldened to keep the war going because of improved economies and stock market gains since the beginning of the year.

"It's probably slicing a few tenths off of U.S. growth already. We haven't decided how far this will go. Claerly the downside risk just escalated significantly, even without the next round," he said. Harris said two big rounds of tariffs are still possible—tariffs on the global automobile industry and the final $325 billion Trump is threatening on China.

Economists expect the hit on China's economy to be bigger at about a half percentage point of growth, and more if the next wave of tariffs is instituted. Goldman Sachs economists said if the trade war escalates the impact to U.S. growth could reach 0.4 percentage points.

"The problem is if you let enough time pass, you're going to set forth a sequence of events in global economies, in terms of creating a slowdown, that isn't going to correct itself by simply saying the tariffs are done," said Emanuel. He said there's also part of the first quarter's 3.2% growth that was inflated partially by a build in inventories. He said there could be pay back for those inventories in the already slower growing second quarter, which is under 2%. Those inventories were accumulated when it looked like an end was coming to the trade war and inventories would be used, he said.

"There's a difference between talking about things and putting your signature on a contract. I think there's ultimately gong to be a deal, but it requires more back and forth. The irony here is if the markets don't respond or continue to respond, the trade war just continues," said Harris. "If everything is calm for awhile, they'll hunker down into their trenches and battle away. I do think it requires more of a sell off in the markets."

via IFTTT

No comments:

Post a Comment