Markets roared with approval Wednesday after the Federal Reserve cemented its "patient" approach to rate hikes, but there was little follow-through Thursday, suggesting that the road ahead may not be so smooth.

The end of rate-hiking cycles has been almost unambiguously bullish for risk assets like stocks. The S&P 500 has averaged gains of 6.1 percent three months after the central bank stops, and 23.5 percent in the two-year period, according to CNBC analysis using Kensho.

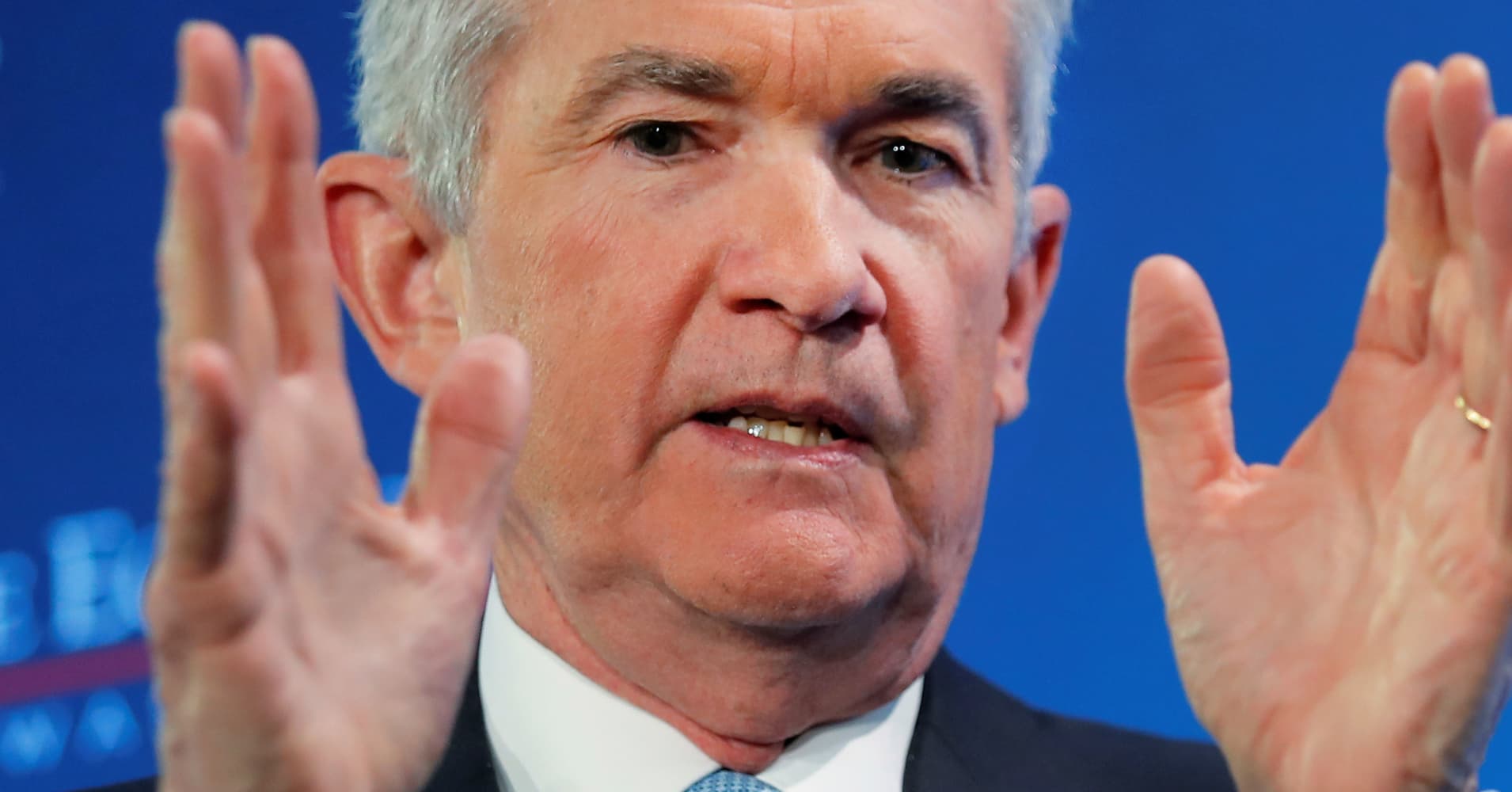

But while Fed Chairman Jerome Powell made it abundantly clear that policymakers are in pause mode for the time being, there's no telling how long that could last.

Should economic barometers hold up and some of the world's geopolitical problems get solved in a timely manner, the Fed could change its tune before 2019 is over.

"Given the right underpinning, I think he'd like to raise rates at least once or twice if there's an opportunity to do that," said Quincy Krosby, chief market strategist at Prudential Financial. "Then he'd need a global backdrop that is solid and a U.S. economy that is on solid footing. We have that now, but there still remain concerns that the economy is going to slow. That tug-of-war has not eased."

Indeed, Powell gave no indication how long the pause would last or whether his fellow officials have changed their minds from the two hikes they had indicated in their year-end forecasts in December.

He said he still sees the U.S. economy in solid condition, but pointed out global concerns like Brexit, the Chinese economy and financial conditions that have "tightened considerably," even though most gauges show they remain loose.

""I would want to see a need for further rate increases," he said at a news conference following the Federal Open Market Committee meeting.

The strikingly dovish tone of the FOMC's post-meeting statement sent stocks surging higher. But it also generated some conversation around "down-side concerns that the Fed 'knows more than we do,'" said Catherine L Mann, global chief economist at Citigoup.

Mann said, however, that her team's research indicates that concerns over growth will fade.

"Powell argued that future policy would be a function of data, and our economists' base-case is for strong domestic growth supporting two hikes in 2019," the economist said in a note.

Similarly, Lindsey Piegza, chief economist at Stifel, said the Fed probably isn't done for the year though it may not execute the planned two rate hikes in the current forecast. The fed funds rate currently is targeted between 2.25 percent and 2.5 percent, the result of eight quarter-point increases that began in December 2015.

As the year progresses, "continually solid domestic data and a reduced threat from overseas would likely create a thaw, allowing at least one further policy adjustment before the Fed throws in the towel," Piegza wrote.

The market still does not anticipate any rate hikes this year, and Citi strategists note that the Fed typically starts cutting rates eight months after the last increase. Current futures pricing points to a 25 percent chance of a quarter-point reduction by the end of the year, and no probability of a hike.

"What happens if we have a spate of unequivocally strong economic data?" Prudential's Krosby said. "I think you're going to start seeing the fed funds futures market signaling a rate hike, and probably the Fed will as well."

via IFTTT

No comments:

Post a Comment