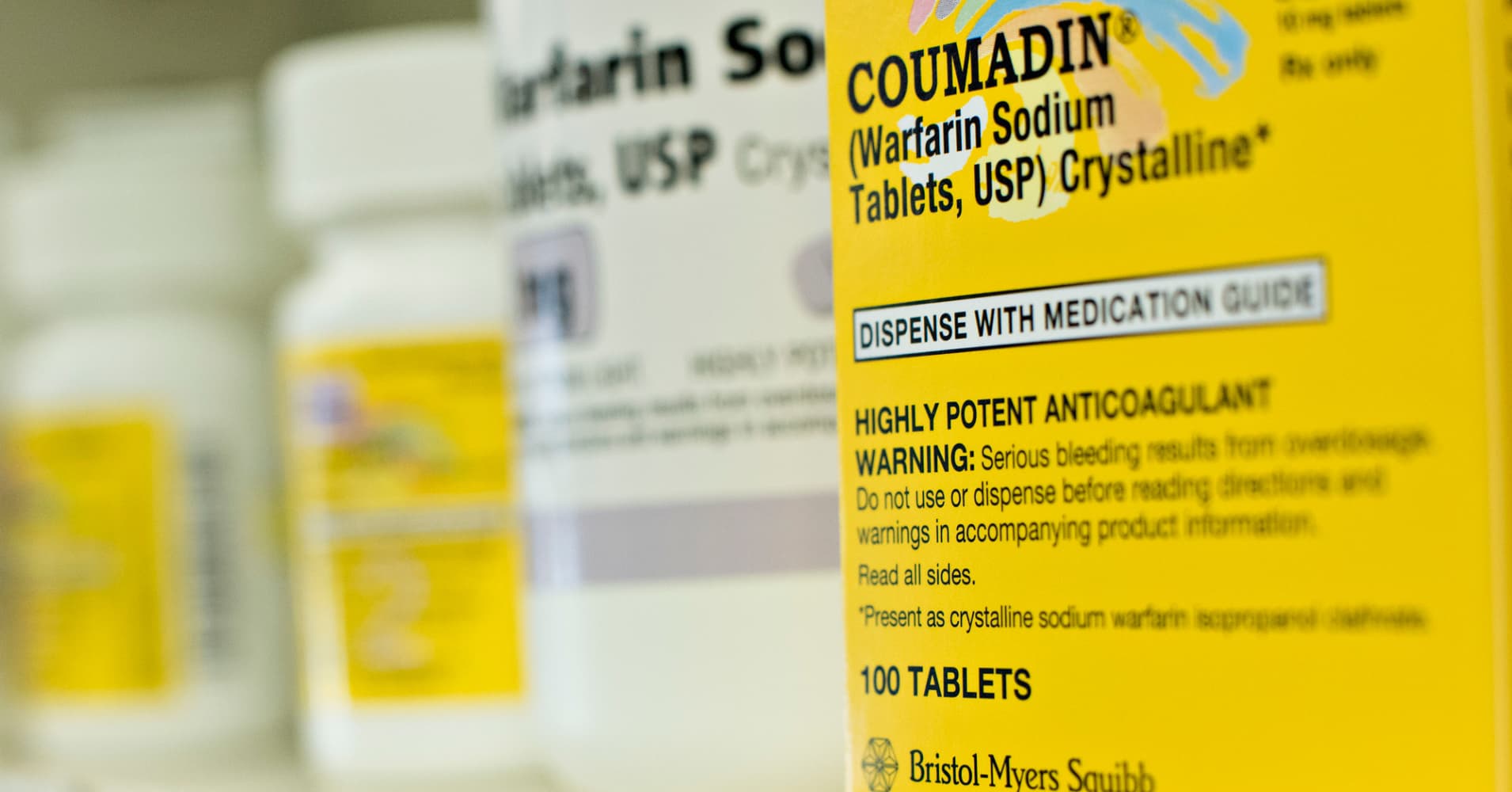

Celgene shares surged 32 percent in premarket trading on Thursday after Bristol-Myers Squibb announced plans to buy the biotechnology company in a cash and stock deal valued at $74 billion.

Under the agreement, Celgene shareholders will receive 1 Bristol-Myers Squibb share and $50 in cash for each share of Celgene.

Shares of Bristol-Myers Squibb were down more than 13 percent in early trading.

"Together with Celgene, we are creating an innovative biopharma leader, with leading franchises and a deep and broad pipeline that will drive sustainable growth and deliver new options for patients across a range of serious diseases," Bristol-Myers Squibb Chairman and CEI Giovanni Caforio said in a press release.

The boards of directors of both companies approved the deal.

Celgene was set to lose patent protection by 2022 for Revlimid, its top-selling multiple myeloma drug.

The company has been working on an experimental new gene therapy called CAR T-cell therapy — taking a patient's own immune cells, called T cells, genetically manipulating them to attack specific proteins on cancer, and infusing them back into the patient.

This story is developing. Please check back for updates.

from Top News & Analysis https://cnb.cx/2CNqsHRvia IFTTT

No comments:

Post a Comment