Americans are cutting back on how much money they spend. More than two-thirds of U.S. adults say they're making an effort to reduce their monthly budget in order to save more, according to a new survey from consumer-financial company Bankrate. But saving isn't the only reason they're cutting back.

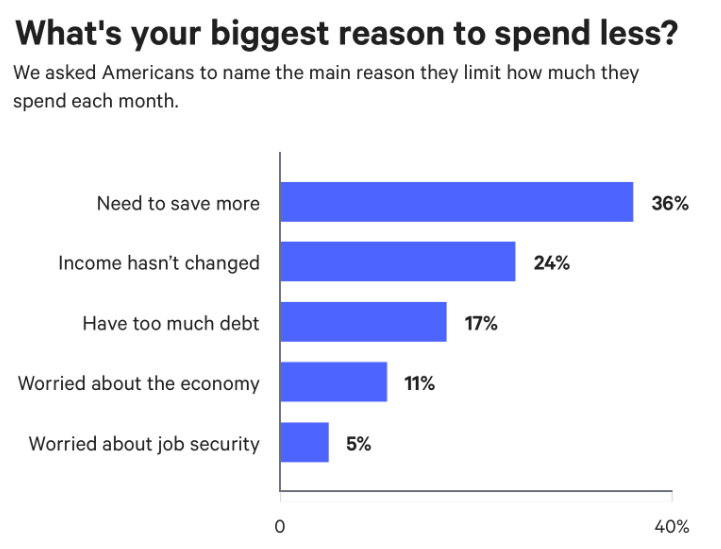

While 36 percent say their priority is saving, 24 percent say they're curbing their spending because their income hasn't changed. About 17 percent say they have too much debt, 11 percent say they're worried about the economy and 5 percent are concerned about job security.

Trying to spend less makes sense for most people, regardless of the reason. A survey from personal-finance website GOBankingRates found that 42 percent of Americans have less than $10,000 put away for retirement, while a Northwestern Mutual study found that a third of Americans had less than $5,000 for retirement and 21 percent had nothing saved at all. And only 39 percent of adults say they have enough in savings to handle a $1,000 emergency.

Meanwhile, middle-class incomes have shrunk in all but two states, credit card debt has hit $1 trillion and student loan debt exceeds $1.5 trillion.

Bankrate: Biggest reason to spend less

Households earning more are most likely to limit their spending in order to save. The survey finds that "households with incomes of $50,000 per year, or more, were more likely to say they needed to limit their spending to save," and "also more likely to report being frugal, on a budget or having no desire to spend more money."

That's compared to households with incomes under $30,000, which are more likely to cut back due to worries about the economy.

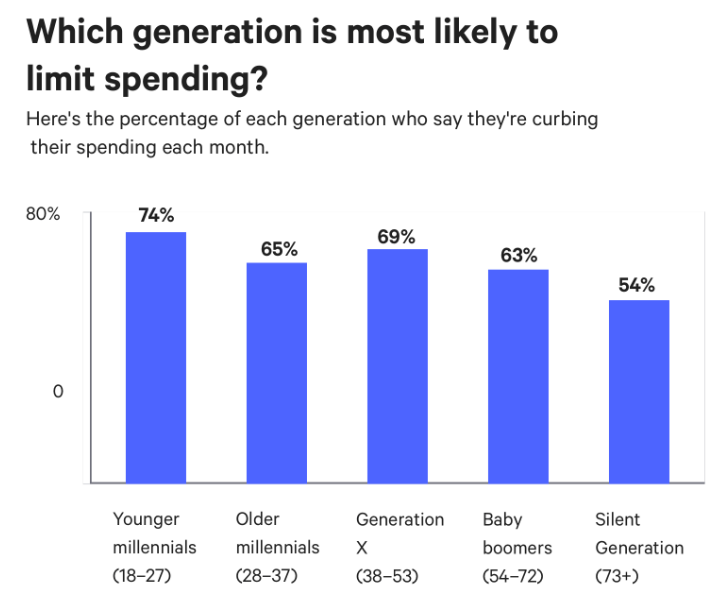

Younger Americans also prioritize saving more than their older peers. About 45 percent of millennials who are cutting back are doing so to save, versus 41 percent of those in Generation X.

"Older Americans aren't showing the same dedication," says Bankrate. "Stagnant income was the top response for Baby Boomers and the Silent Generation."

Bankrate: Generation most likely to limit spending

Whatever the reason for cutting down on spending, there are some strategies that could help you out, "starting with a budget," the survey says.

"After subtracting fixed monthly expenses" like rent or a car payment from your income, allocating funds to variable expenses like food and entertainment "will give a clearer picture of how much you should be spending each month. Experts recommend taking a monthly average of variable costs to determine how much you'll need to budget for; after, evaluate the categories and see where you can cut costs."

Tom Corley, author of "Rich Kids: How to Raise Our Children to Be Happy and Successful in Life," recommends the 80:20 rule, in which you live off 80 percent of your paycheck and save the rest. "It's a simple rule," he writes, that you can follow no matter how much you make.

Whatever your income and expenses look like, know what you spend each month and create a budget. With his budget, this customer service rep paid off $30,000 in student loan debt in one year. And with theirs, this couple is trying to pay $600,000 in five years.

Here are some additional tips on how to better manage your money.

Like this story? Subscribe to CNBC Make It on YouTube!

Don't miss: You can make $86,000 a year at this entry-level job—and over $50,000 at these 3 others

via IFTTT

No comments:

Post a Comment