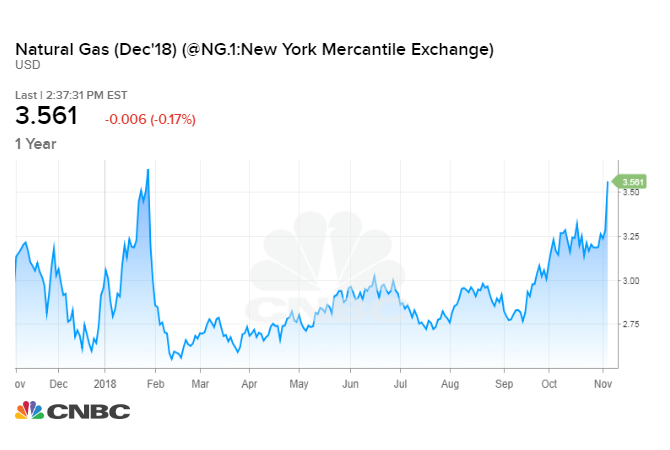

Natural gas prices are surging after a dramatic change to U.S. weather forecasts indicates that winter-like temperatures will grip much of the country in the coming days.

The surprise forecast comes on the heels of a two-month rally that pushed natural gas futures up 12 percent through last week. Prices have lately been trading at highs going back to January as U.S. stockpiles of the fuel sit near the lowest levels in over a decade going into the winter season.

On Monday, natural gas prices rocketed another 8.6 percent higher. Prices hit a session peak of $3.58 per million British thermal units on Tuesday, the highest level since Jan. 29.

"There was a big change in the weather forecast. Not only did it turn colder but it turned much colder in some key heating regions," said Jen Snyder, director of RS Energy's gas market practice.

Over the last few days, warm weather patterns broke down, giving way to forecasts that showed colder-than-normal temperatures taking hold throughout much of the country. Forecasts are now pointing to temperatures in mid-November that are more typical of the middle of December, with cold bursts expected in the Midwest, across Texas and the South and throughout New England.

"This is one of the largest weekend changes we've seen," said Jacob Meisel, chief weather analyst at Bespoke Weather Services. "The order of magnitude of cold change caught everyone off guard."

Analysts say the run-up reflects concerns that natural gas held in underground storage throughout the country will run low toward the end of the winter, making it harder to deliver the commodity in some regions. To keep natural gas storage levels adequate during a cold winter, prices need to rise enough to incentivize drillers to increase production or force some consumers to turn to other fuel sources.

"What's really going on here is that the market is trying to protect the storage it has in the ground," said Meisel. "As a result you're probably going to see strength across the basis market in areas that might not even get that cold."

6-10 Day Temperature Outlook, source: National Weather Service

Natural gas storage inventories are well below their five-year average after a warmer-than-usual August boosted air conditioning use and nuclear power plants closed during the recent hurricanes.

During the summer, it looked like the United States would exit the winter with about 1.5 trillion cubic feet of natural gas in storage, said Snyder at RS Energy. It now appears those levels will be closer to 1.2 trillion-1.3 trillion cubic feet, and a cold winter could cut inventories by another 400 billion to 500 billion cubic feet.

Snyder said this week's price spike is not necessarily surprising given how complacent the market had grown about low inventory levels.

"It seems like the market placed almost no value on storage this season just because we've seen such strong production growth," Snyder said.

While U.S. natural gas production is indeed soaring, the country is also using more natural gas at power plants and industrial projects. The United States is also ramping up exports of liquefied natural gas, a form of the fuel chilled to its liquid state for shipment on giant seaborne tankers.

If the cold persists this fall and winter, natural gas prices could rise above $5 or $6 per mmBtu for weeks at a time, according to Snyder. Traders have not seen those price levels since the polar vortex that plunged the United States into extreme cold during the winter of 2014.

"It really depends on when it gets cold, which is why this cold snap is spooking the market," Snyder said. "Early cold weather is going to have more of an impact than later cold weather."

from Top News & Analysis https://ift.tt/2SRrSqTvia IFTTT

No comments:

Post a Comment