It's the moment of truth for Apple as the trillion-dollar tech giant gears up to report its latest quarterly earnings.

Apple shares are up nearly 30 nearly percent this year, and have held up relatively well amid the recent tech downdraft. According to Dan Nathan of RiskReversal.com, options traders are betting shares of the iPhone maker could have even more room to run.

The options market is implying a 5 percent move in either direction for the stock when the company reports fiscal fourth-quarter earnings after the bell Thursday – that's a roughly $50 billion shift in market cap. Nathan noted that options traders are targeting the 220 strike into the event. On Wednesday, he highlighted a block of traders that purchased the Nov. 2 weekly 220-calls paying an average of $4.70 per contract. This is a bet that Apple will rally above $224.70, or up about 3 percent, by Friday.

"It looks like a lot of those were bought [as] near the money ways to participate to a move back towards those prior highs," he said Wednesday on CNBC's "Fast Money."

Nathan also noted that despite the sharp volatility in the markets of late, shares of Apple have remained relatively unscathed compared with the moves for other large tech names like Microsoft and Alphabet.

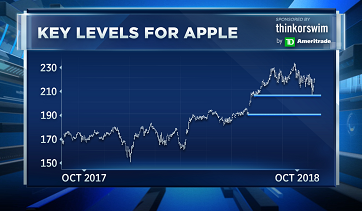

"Obviously there's some support just below current levels, and then $190 that's the air pocket on any disappointment down to the prior quarter level," Nathan said.

Shares of Apple are up nearly 32 percent in the past year and were higher Thursday afternoon at around $219.57.

via IFTTT

No comments:

Post a Comment