Friday's stock market rally is a good example of why it's never a good idea to follow crowds on Wall Street, especially during sharp downturns.

Panic-selling for long-term investors almost always ends poorly. Investors that kept their wits during the financial crisis ended up recouping not only all their losses but also were still around to participate in the longest-running bull market in history.

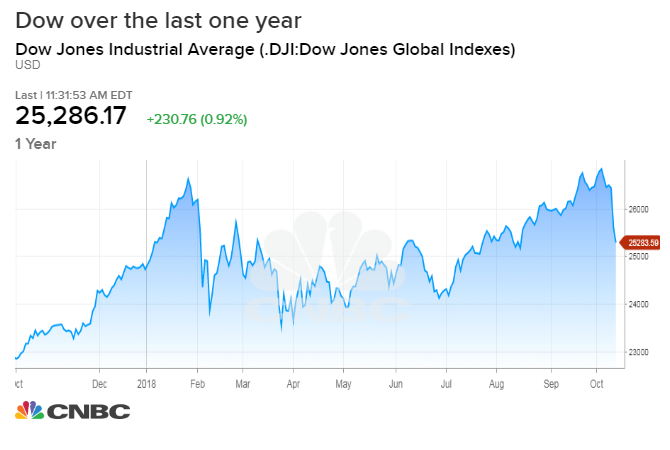

The market currently is amidst a downturn that has taken it sharply lower from recent record highs, with the Dow Jones Industrials Average off nearly 5 percent in just the last week or so.

However, investors earlier this year saw a similar scenario play out. Markets went into correction mode following an inflation scare in late January and early February. Soon after, though, a rebound took the market to new highs.

Stocks rallied Friday, helping to erase some of the losses. While there's no guarantee there won't be some more substantial declines in the days ahead, it's always best for long-term investors to maintain goals.

As my co-author Peter Tanous and I stated in "The 30-Minute Millionaire" book published in 2016: "Many investors panic and jump out of the stock market at precisely the wrong time. This is largely a function of irrational investment decisions based on emotion."

Some basics to consider at times like these: Are fundamentals strong? What is the outlook for corporate earnings? How is the economy behaving? Where are interest rates?

It may well be that a look at your portfolio could show that your asset allocation has gotten out of whack. There's nothing wrong with rebalancing and bringing your investments back into line with your long-term goals.

But basing those decisions on emotion and over what has happened over the course of a few days doesn't make sense for those in for the long haul.

Watch the video above for more...

from Top News & Analysis https://ift.tt/2CbKiwkvia IFTTT

No comments:

Post a Comment