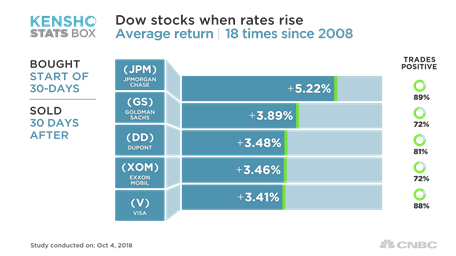

Interest rates are surging and stocks like J.P. Morgan Chase and Goldman Sachs would make great additions to a portfolio in times like these, if history is any indication.

Shares of J.P. Morgan surge an average of 5.2 percent over a one-month span when rates are rising sharply, while Goldman's stock averages a gain of 3.9 percent in such instances. Banks usually benefit from higher rates as they make loans more profitable.

DowDuPont, Exxon Mobil and Visa are also among the best-performing stocks in this environment. When rates move sharply higher, DowDuPont and Exxon Mobil both average gains of 3.5 percent, while Visa posts averages a rise of 3.4 percent.

CNBC used analytics tool Kensho to determine the best-performing stocks in the Dow Jones Industrial Average when the 10-year Treasury note yield rises 25 basis points or more over a span of 30 days. There have been 18 instances of such a move happening since 2008. This week alone, the 10-year yield has risen more than 15 basis points.

Strong economic data and comments on U.S. monetary policy from the top Federal Reserve official have been a boon for interest rates this week.

On Friday, the Labor Department reported the U.S. unemployment rate dropped to its lowest level since 1969 in September. Wages, meanwhile, grew by 2.8 percent on a year-over-year basis.

The U.S. services sector also grew at its fastest rate on record last month, according to data released by the Institute for Supply Management.

Meanwhile, Fed Chair Jerome Powell said Wednesday the central bank was "a long way" from getting interest rates to neutral, signaling more rate hikes are coming. The Fed has already raised rates three times this year and is expected to raise rates again in December.

All of this has led the 10-year U.S. note yield — which is used as a benchmark to determine mortgage rates — to jump from around 3.06 percent on Monday to above 3.2 percent, near its highest levels in more than seven years.

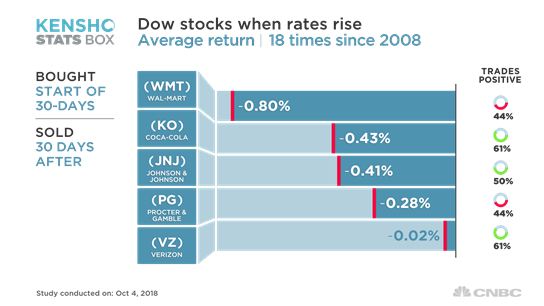

But while stocks like J.P. Morgan, Goldman Sachs and Visa do well when rates are surging, Walmart and Coca-Cola struggle.

Walmart averages a loss of 0.8 percent when rates rise 25 basis points or more in one month, the worst performance of any Dow member in those instances since 2008. Coca-Cola, meanwhile, drops an average of 0.4 percent.

Johnson & Johnson, Procter & Gamble and Verizon also average losses when rates rise sharply.

These stocks usually pay high dividends, which become less attractive when interest rates rise.

via IFTTT

No comments:

Post a Comment