Microsoft is poised to end trading Friday as the most valuable publicly traded U.S. company, surpassing Apple.

Microsoft passed Apple in market cap again during intraday trading Friday, though Apple could retake the lead before market close.

As of 3:30 p.m. in New York, both stocks were trading at about a $849 billion market valuation, based on outstanding counts. Microsoft reported an outstanding share count of 7,676,218,736 shares as of October 19, 2018 in the company's most recent filing. Apple reported an outstanding share count of 4,745,398,000 shares as of October 26, 2018.

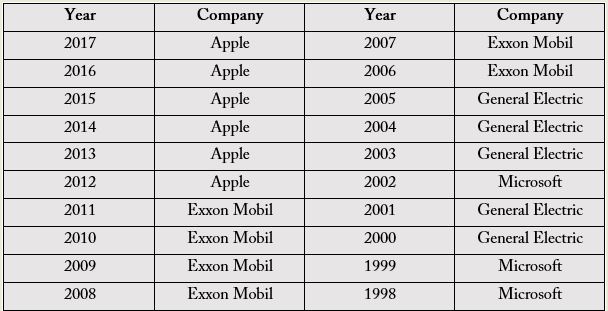

The two stocks jockeyed for the top spot for most of the week, with Microsoft surpassing Apple for seconds or minutes at a time. But Apple consistently beat out Microsoft in market valuation at market close each day so far. If Microsoft ends the year as the most valuable company, it will be the first year it closes out in the top position since 2002.

Source: S&P Dow Jones Indices

Apple eclipsed a trillion-dollar market capitalization in August to become the first publicly traded U.S. company to hit the historic valuation. Amazon crossed the trillion-dollar threshold during intraday trading five weeks later, but has never closed trading above the benchmark.

Apple's stock has had a painful few weeks, spurred by disappointing earnings on Nov. 1 and an announcement that it would no longer disclose how many iPhones, iPads and Macs it sells each quarter, reducing transparency for investors. Shares have lost roughly 20 percent of their value in the last month.

Meanwhile, Microsoft stock has tripled in the past four years under the leadership of CEO Satya Nadella. It passed Google parent Alphabet by market cap and is up roughly 1 percent in the last month.

—CNBC's Patti Domm and Tom Franck contributed to this report.

This is breaking news. Please check back for updates.

WATCH: Apple's stock performance reflects its key tenets, says Bernstein's Sacconaghi

via IFTTT

No comments:

Post a Comment