The vast majority of Americans, 78 percent, say they're "extremely" or "somewhat" concerned about not having enough money for retirement, according to Northwestern Mutual's 2018 Planning & Progress Study. And for good reason: A shocking 21 percent of Americans have nothing at all saved for the future and another 10 percent have less than $5,000 tucked away, the study finds.

That means about a third of Americans have only a few thousand dollars put away, or less, for their golden years.

Some respondents are more prepared: A quarter report having $200,000 or more stashed away, while 16 percent have between $75,000 and $199,999. But overall, Northwestern Mutual found that Americans average $84,821 in retirement savings, which is far from enough. Experts typically recommend trying to accumulate at least $1 million.

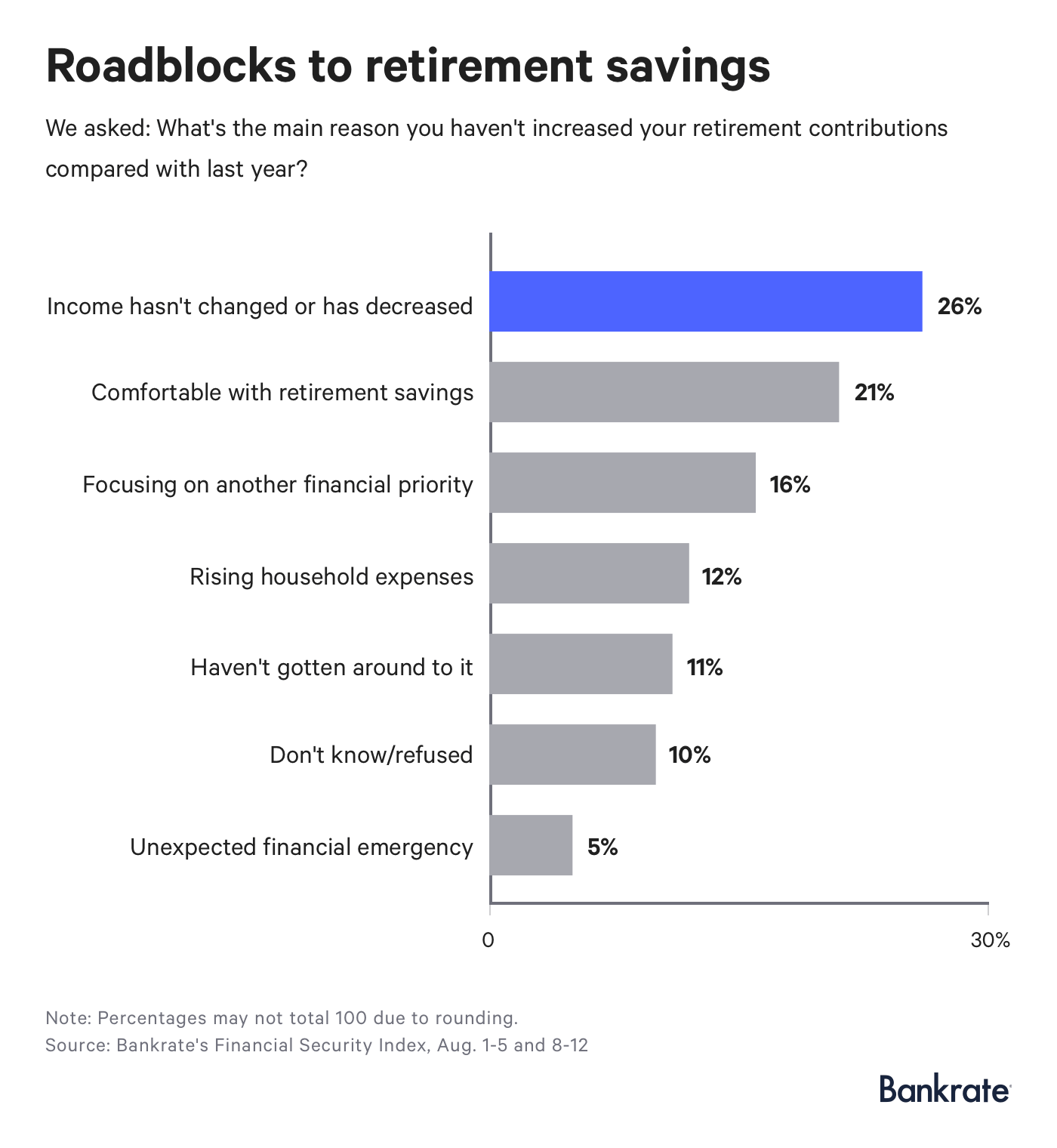

A new survey from Bankrate finds that 13 percent of Americans are saving less for retirement than they were last year and offers insight into why much of the population is lagging behind. The most popular response survey participants gave for why they didn't put more away in the past year was a drop, or no change, in income.

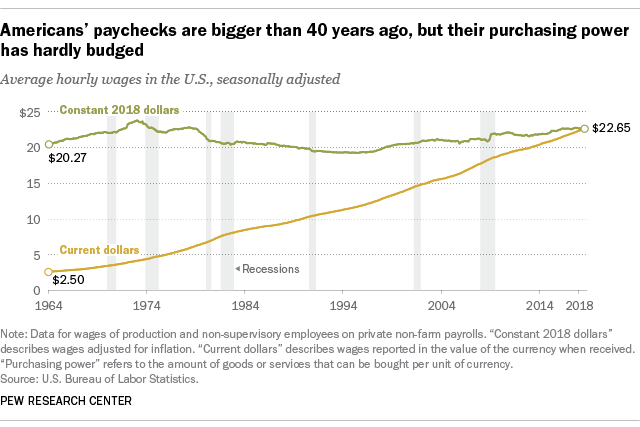

"That's consistent with federal data that show real wages have barely budged in decades," Bankrate reports. According to the Pew Research Center, the average paycheck has the same purchasing power it did 40 years ago.

Day-to-day costs continue to soar and salaries don't go as far as they did to cover the necessities, author and executive director of the Economic Hardship Reporting Project Alissa Quart tells CNBC Make It. That makes it more difficult to set aside money for the future.

Still, the longer you put off planning for your golden years, the farther behind you'll fall.

The good news is, there are ways to make progress without feeling cash-strapped or committing to any drastic lifestyle changes. Here are three effective strategies:

1. Start ASAP. The sooner you begin putting your money to work, the less you'll have to save each month to reach your goals, thanks to the power of compound interest.

If you start at age 23, for instance, you only have to save about $14 a day to be a millionaire by age 67. That's assuming a 6 percent average annual investment return. If you start at age 35, on the other hand, you'd have to set aside $30 a day to reach seven-figure status by age 67.

2. Automate. If you automate your retirement savings — meaning, you have a portion of your paycheck sent directly to a retirement account, such as a 401(k), Roth IRA or traditional IRA — you'll never even see the money you're setting aside and will learn to live without it.

Ideally, you'll want to work your way up to setting aside at least 10 percent of your pretax income but, if you're only comfortable with setting aside 1 percent, start there!

Check online to see if you can set up "auto-increase," which allows you to choose the percentage you want to raise your contributions by and how often. This way, you won't forget to up your contributions or talk yourself out of setting aside a larger chunk when the time comes.

If you can't find the feature online, call your retirement plan provider to find out what's possible.

3. Bank any surplus money. Whenever you come across any extra cash — a bonus, birthday check or small windfall — rather than blowing it on a new pair of shoes or a vacation, send at least a chunk of it straight to savings.

To resist the temptation to spend any surplus money, deposit it right away, so you never even see it.

Don't miss: The economy is booming, yet Americans are struggling. An award-winning author explains why

Like this story? Subscribe to CNBC Make It on YouTube!

via IFTTT

No comments:

Post a Comment